Agentic Payments - The Essential Building Block for the Agentic Shopping Future.

Our deep dive into all things Agentic Payments - what's been announced, what do we predict is coming, where do we go from here?

Brief Backgrounder on Payments in Ecommerce

If you think about what it will take for AI Shopping Agents to be a reality, and you think about the Research, Find, Buy cycle - there are some touch challenges in each, but the hardest challenge is Pay. This is because the movement of money is where you have the most regulation, fraud risk, cybersecurity, etc. It’s also a very complex part of the ecommerce tech stack. If you want to go deep into payments, check out pymnts.com. But what we’ll do is walk you through the basics

Payment Methods: Digital Wallets, Credit Cards, BNPL

This table shows that there are basically three buckets of payment methods we should think about:

Digital Wallets (54%+) - Turns out on the internet, especially on mobile, people hate to constant enter their credit card digits and they feel more secure and enjoy the convenience of digital wallets. The biggest mobile wallet is PayPal, then we have Amazon Pay, Google Pay, Apple Pay and Shop Pay.

Credit/Debit cards (26%+)- The lingua franca of commerce, at the end of the day, it all comes down to credit cards. There are four big credit/debit cards in the US: Visa, MasterCard, American Express and Discover.

BNPL (6%)- Buy-Now-Pay-Later is increasingly popular: Affirm, Klarna and Afterbuy are the big three there.

In e-commerce A2A (ACH, venmo, cash app) are very unusual and not taken as payment for our purposes. You also have gift cards and loyalty programs and private label credit cards. For now let’s keep it to these three buckets. I’m also keenly aware this is a US centric view of the world.

Checkouts

To make matters more complicated, many of the digital wallets and even credit card enablers (Stripe/Braintree) offer full checkouts, so instead of choosing your payment system at the end of the checkout flow, increasingly you have a ‘choose your checkout’ flow. For example, Stripe, Shop Pay and PayPal have complete checkouts. These tend to be more popular with smaller stores as big retailers with big teams want to control and measure more steps of the process. That being said, because of it’s insane conversion rate, Shop Pay’s checkout is increasingly being used by bigger and bigger brands and retailers -especially in the Shopify ecosystem (core Shopify and Shopify Plus).

Payment Data for Top 1000 Online Retailers

For our purposes here on Retailgentic - the intersection of Digital Shopping and Agentic Shopping, this is the most important chart -the top 1000 retailers (by revenue) and what they accept:

For example, Amazon’s ‘Buy for Me’ agent can currently only buy products using Amazon Pay. That reduces Amazon’s BFM agent ‘total addressable market’ from 100% to 12.6%.

Retailgentic thesis: Agents will build to pay with credit/debit card as that is the lowest common denominator.

PCI Compliance, Security and Agents

I’ve had the joy (that’s sarcasm) of building and maintaining a PCI compliant (PCI is the credit card industry’s standard for secure store and transmission of credit-card information). Suffice it to say, we have a challenge here:

Ideally AI Shopping Agents will pay with credit cards to cover the LCD

Shopping Agents can’t just take your digits and splat it over the internet into a website.

Fortunately there are several solutions for this:

Intermediate card - Here you take the user’s credit card - CC1 and you charge it, say $100 for the transaction. Then you create a new digital debit/credit card, CC2 and you put $100 on that card and that is what’s entered in the checkout. CC2 is then virtually shredded. The problem with this approach is the agent that charges CC1 pays the processing fees AND the underlying merchant also pays processing fees. Thus worst case your fees go from 2-3% to 4-6% (eek!)

Single use ‘virtual card’/ clone - Newer technology exists from the credit card companies where they will allow you to create a virtual card from your card. Like the ‘intermediate card’ there are APIs to create these on the fly digitally (no plastic), these have different numbers and they can have a lot of restrictions: “hey amex, create a virtual card of my card and put $100 on it to be spent at Academy Sports only.” This card is entered with zero to no risk and then evaporates when used. If it’s somehow stolen, even down the road, it’s useless.

Someday, the credit card companies may create a way for Agent-to-Agent (essentially API server to server no open internet in the loop).

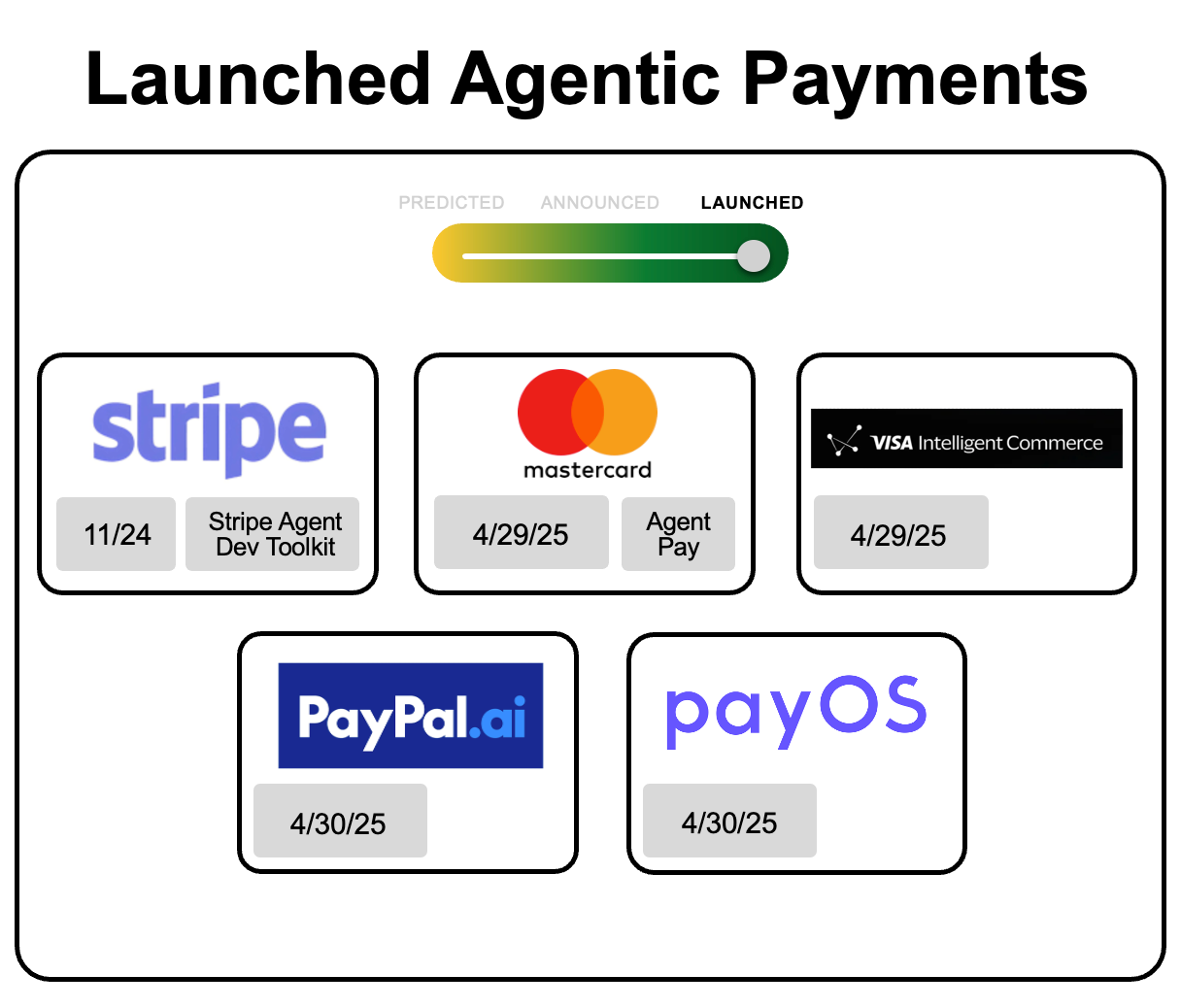

Agentic Payments - Here Today

With that background we can now dig into where we are as it relates to Agentic Payments. the good news is we already have five players on the field and w anticipate more coming

Stripe

Stripe was ahead of the curve and in November of 2024 released an Agentic payments SDK (group of APIs).

Then March 13th they demonstrated what I think is the first Agentic payment ever. Engineer Evan Fenster put together a coffee buying agent that used an ‘operator’ style browser’ and the Stripe Agentic API to allow that agent to go buy bags of coffee at a retailer that accepts stripe. It’s still pretty cool and, yes, I ordered coffee using it and it is awesome. Details and < 5min video live here and you can try it out for yourself via www.baristaagent.com

Then May 7th, at their annual big conference, Stripe Connections, they announced more infrastructure around the previously announced offerings. Details on Stripe’s Agentic capabilities live here and here’s an interesting detail:

Stripe is a real contender here, but think of them as a set of developer capabilities on the agentic front-end and the merchant back end. At the end of the day, currently,

Stripe and Stablecoins?

Stripe is a big believer and investor in the corner of Crypto called stable coins. At a super-high level, stable coins all you to take an old-world currency, like a dollar, make it digital (convert it 1:1 into a stable coin) and once it’s a crypto-currency, you are off the old bank/credit card ‘rails’ which means you can move money faster, easier, and most importantly, much much cheaper. There’s speculation that Stripe could have an Agentic stable card offering and my guess is the appeal there is speed of execution, Crypto is a more modern security metaphor vs. PCI and ultimately, hopefully, fee savings.

Primer on Agentic Payment Friction

I’m a bit skeptical on stablecoins for agentic payment because if consumers have to have a crypto wallet and all the complexity that comes with that and also this model forces integrations on all three sides of the transaction:

Consumer - The consumer needs to setup and load a stablecoin wallet

Merchant - The merchant will have to accept stablecoins and implement in their platform(s). They’ll also need to figure out a policy on how large a balance to keep and how to xfer to USD

Agent - Finally, the agentic layer has to be the intermediary in all of this.

That’s a lot of friction, maybe for CBT transactions as a second-order aspect or B2B element of agentic commerce, but not the first wave consumer domestic wave.

In fact, zooming back up to 30,000-ft, the early winners in Agentic payments won’t require the consumer or merchant to change anything and they’ll give the agent a simple API or tokenized payment mechanism that allows for easy integration.

The companies best positioned to do that are the card issuers and the existing wallets.

Introducing: Visa Intelligent Commerce

On April 29th, Visa announced Visa Intelligent Commerce with a big public announcement featuring the Visa CEO.

Visa has the most information out and it’s worth looking at their vision.

Visa Intelligent Commerce Launch Partners

Visa launched with a great list of partners: OpenAI, Perplexity, Microsoft, Anthropic and Mistral. In fact, the only major ‘frontier model’ missing is Google’s Gemini - which we would later learn at Google I/O is starting with a GPay oriented solution and Amazon.

Also note that Agentic shopping-wise - Microsoft hasn’t launched only announced, and Anthropic + Mistral have not announced anything yet, but this basically lets the cat out of the bag.

Friction check:

Consumers - Already have Visa and just have to authorize

Merchants - 99.9% of merchants already take Visa

Agents - This is where the friction is and Visa has come out strong with great launch partners at launch. They are winning the zero-friction war here out of the gate.

Visa’s ‘agentic wallet’ payment workflow

Visa’s workflow is interesting, in the product demo above they show this UX workflow:

Add - the consumer adds their visa agentic wallet to their GenAI agent

Personalization - is a setting at add (more on this later)

The agent then goes and finds an item

The user is then presented with a ‘wallet authorization’ , such as: “The agent wants to charge your card $219 for soccer tickets, approve?”

As Agentic shopping is new, this UX makes sense because the user needs to build trust, but down the road, you could imagine a less noisy/friction experience where the AI agent has a budget and a pre-auth or has some parameters (e.g. reorders) where it doesn’t need to bug the user for every auth.

It’s going to be interesting to see how this develops over time, we’ll be paying close attention and highlighting innovation as we find it.

Visa personalization

On the Visa Agentic Payments landing page, they talk about personalization: 85 + real-time “personalization signals” - transaction history patterns, merchant category affinity, typical ticket size, geo-velocity, loyalty status, etc. - are exposed to developers through the new Visa Intelligent Commerce APIs so agents can show the “right” offer, set user-level spend limits, or auto-trigger disputes.

Here’s an example, let’s say you are looking for concert tickets and your buying patterns shows 80% of your purchases are with ticketmaster and 20% with stubhub - now the agent knows you have a merchant preference.

In the Visa launch they gave a travel example: “Bob has never spent more than $200 on a hotel room, so the agent knows to priortize that price point when looking for rooms.”

I’m a little sceptical on this one, we’ll have to see how it plays out. It seems like over time the agent will have much deeper and better signal than this, but LLMs love context, so we’ll see.

Visa deep dive

If you want to learn more about Visa’s Intelligent Commerce offering, here’s the complete vido (which is really good if you want to geek out on this stuff with me)

Mastercard

On the same day, 4/29, Mastercard announced Agent Pay. Their launch partner was Microsoft only with ‘more to come’.

Like Visa, Mastercard has 99% coverage already so they are close to Visa on the friction side, but had fewer launch partners, so I’m scoring them a close second.

Where’s the beef?

Unlike Visa, Mastercard felt rushed, there was a press release with some simultaneously specific AND vague scenarios like this:

This means that for a soon-to-be-30-year-old planning her milestone birthday party, she can now chat with an AI agent to proactively curate a selection of outfits and accessories from local boutiques and online retailers based on her style, the venue’s ambience, and weather forecasts. Based on her preferences and feedback, the intelligent agent can make the purchase, and also recommend the best way to pay, for example using Mastercard One Credential.

I strongly suspect a 30yr old drafted this -haha. But there is no landing page on Mastercard, no product videos, etc.

It feels like Mastercard got wind of Visa’s offering and had to scramble to get out the same day.

Speaking of which….

PayPal

Yes, you guessed it, on 4/29 PayPal announced at their developer conference their Agentic AI payment offering - under the brand PayPal.ai. In the spirit of a developer conference, their announcement lacked the polish that you see with the Visa release and instead focused on support of MCP and the new A2A protocols

Going Deeper on PayPal.ai

If you want to go deeper, first checkout the landing page here. Then this YouTube video has some interesting examples of a merchant using MCP to ‘chat’ with their payment transactions.

PayPal and Perplexity tie up

Shortly after the PayPal.ai announcement, PayPal and Perplexity announced a collaboration coming this Summer. Given that Visa has also tied up with Perplexity, it seems unlikely that PayPal will be an exclusive offering, but maybe it will be ‘recommended’? I’m sure the Agents, like the platforms and the marketplaces will be working to monetize the payment and shipping aspects of this ecosystem. Shopify has shown savvy observers, that’s where the gold lays in these layers.

PayPal Friction Analysis

Unfortunately all the PayPal materials are from the merchant’s perspective, no consumer or agent integration is known yet so we’re waiting to see.

That being said, remember, PayPal is only on 72.5% of retailers sites. So if you really want to cover 100% you’ll need a Visa/Mastercard/Amex option.

PayOS

PayOS - When ReFiBuy came out of stealth, the first potential partner to reachout is now branded PayOS. They were founded by 2 payments gurus and came out of stealth 4/30 and announced partnerships with Visa and Mastercard.

Think of PayOS as a company building a neutral, multi-payment developer option for the three sides mentioned above. This saves the developer from doing individual integrations with all X (today 2, we have yet to hear from amex/discover and the BNPL folks) payment options.

Up Next…

That’s a summary of where we are. In our next post (unless there’s some breaking news) we’ll reveal our predictions on the next wave of agentic payments.

This is such a fantastic write up. I hadn’t seen the Visa intelligent commerce demo - that’s pretty wild. I don’t know why, but I always perceived MasterCard to be ahead of Visa in terms of the next evolution of web three payments but I guess I was wrong.

What a time to be alive, eh?

Take a look at Nekuda.ai, which offers an SDK to help create agentic payments without the need for a human presence. Raised capital recently and are part of the Visa Intelligent Commerce programme.