Agentic Shopping News for the Week of 7/27-8/1 (week 31/52)

AI learnings from Public company Q2 earnings, OpenAI+Anthropic big moves, and this week's Agentic Shopping Highlights. Plus we learn what a quadrillion is.

While not specifically about Agentic Commerce, I think it’s a helpful backdrop to quarterly track what’s going on with the big public AI companies. Agentic Commerce is ‘downstream’ of the macro AI trends, therefore, a high-level understanding of what’s going on ‘upstream’ can help predict the future of Agentic Commerce. This week we learned that future is quite bright and the amount of investment going into the AI World is insane.

In case you aren’t familiar with this AI lingo, here’s a quick cheatsheet:

Hyperscalers: companies that run massive cloud operations.

AWS - Amazon Web Services

Azure - Microsoft’s cloud solution

GCP - Google Cloud Compute

XAI - Note that they have built their own

Oracle - Has long been operating large datacenters and is actively building out GPU infrastructure

OpenAI - Has/is building some of it’s own infrastructure

Frontier Models: Sometimes called state-of-the-art or foundational models, the leading LLMs (keeping it to US here to reduce complexity)

OpenAI’s ChatGPT

Google Gemini

Anthropic Claude

Meta Llama (open-weight)

XAI Grok

AI Earnings Week Recap

Google - A Quadrillion of Tokens!

Wed July 23rd, Google kicked off the AI company earnings season. The core Google search business performed well growing 12%, but concerns about GenAI impact on search volume AI Overviews reducing monetization were not really addressed adequately by management.

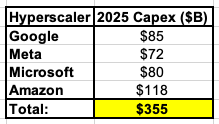

As it relates to GCP, Google announced they are increasing 2025 capex from $75 to $85m due to the amount of demand they are seeing for AI. GCP’s y/y growth accelerated.

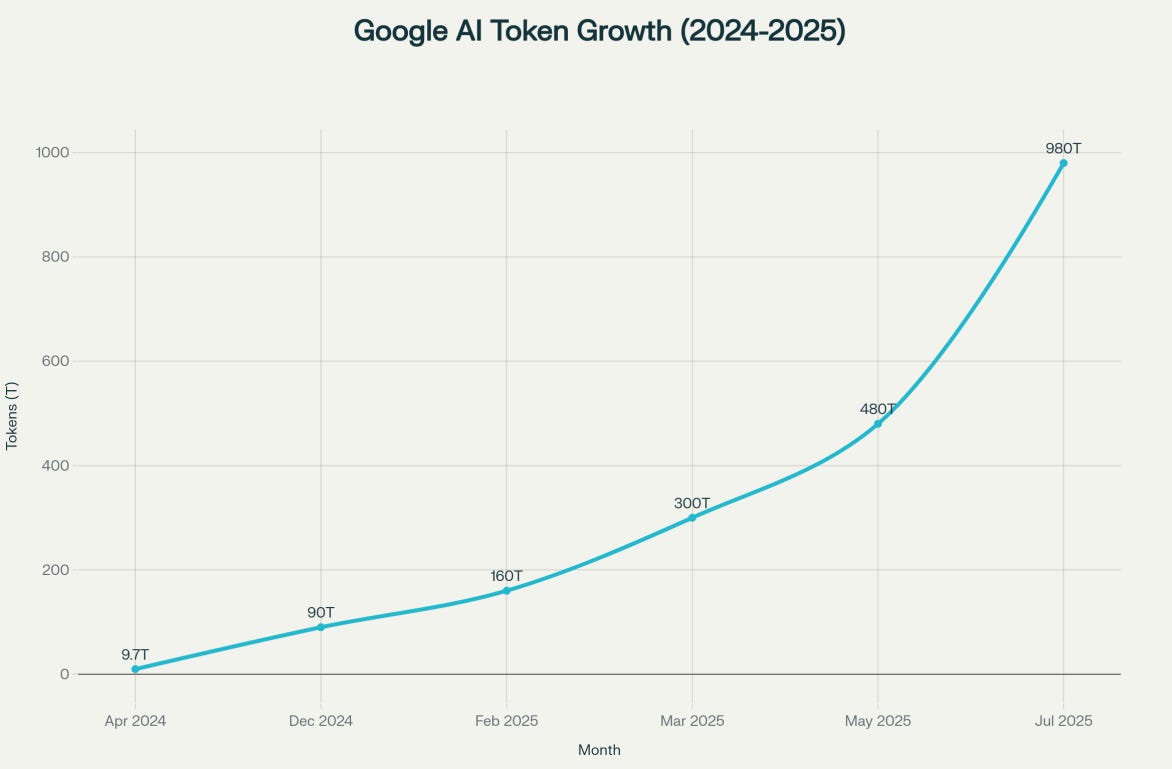

Google did include a new disclosure - they stated they generated 980 Trillion tokens processed monthly. BTW, that’s dangerously close to 1000 Trillion or a Quadrillion. That will certainly be crossed in Q3 at this pace of growth. More on Tokens output and Capex after the earnings summary.

Wall St. took Google’s news as somewhat mixed and the stock was flat to down 1-2%

Meta

Up next was Meta on Wed July 30th. Meta had a classic beat and raise. Their core business accelerated from 16% y/y growth to 22% thanks to their heavy investment in AI. They are putting AI to work through the entire Meta ad ecosystem and it’s really bearing fruit. Meta announced that their 2025 Capex will be $75b. Wall St. was pleasantly taken by surprise and the stock was up 4-8%.

Microsoft

Like Meta, Microsoft was another beat and raise. The announced all AI revenue grew 157% y/y and for the first time they broke out Azure as a separate business unit and announced that it grew 39% vs. anticipated 34%. Microsoft announced their 2025 cloud Capex would be $80b.

Amazon

Expectations were high for Amazon’s AWS coming into the Thursday July 31 earnings announcement because GCP and Azure both saw nice Q→Q growth acceleration.

Interestingly, the Retail part of Amazon was a clean ‘beat’ on top and bottom line. But, AWS met growth expectations, but not the bottom line. They said that AI demand was outstripping AWS’s ability to keep up which seemed good. But, then on the management call, Andy Jassy caused more confusion than help leaving some concerned that there’s a structural issue that Amazon is facing. Correspondingly the stock was down 8.3% the day after. Amazon is spending $118B on

What to go deeper?

We covered earnings in more on the Jason and Scot Show here:

Great Chart

This chart from Altimeter’s clouded judgement substack does a great job of visualizing the y/y growth, ‘bookings’ per quarter and ‘net new’ ARR growth (best predictor of future growth).

This visually shows why Wall St is concerned, look at those record bookings that Azure and Google are seeing

Tokens and Capex

The two big pieces of where this fits ‘upstream’ of Agentic Shopping are Tokens and Capex. Let’s look at Tokens first.

Tokens

The way LLMs work is you give them tokens - the prompt, and they generate tokens (the ‘answers’) in the response. As mentioned in the Google results, they made new disclosures about tokens generated. These tokens wouldn’t be being generated if consumers weren’t use Gemini, using AI features in core Google products, and looking at AI Overviews. Here’s a chart of the prior Google token disclosures and the

The tokens generated went from $480T to $980T - a doubling in one month. We’ve never seen anything like this before growing as fast as it is at the scale it is growing at.

I mention this context because it’s important to understand the Capex.

2025 GenAI Capex Roll-up

If we take all the Capex from those earnings and add them up we get:

$355B! That doesn’t include the investments by Oracle, OpenAI, XAI and many more companies building out GenAI infrastructure. Putting those in the mix gets us to $500B, or half a Trillion dollars investment in one year.

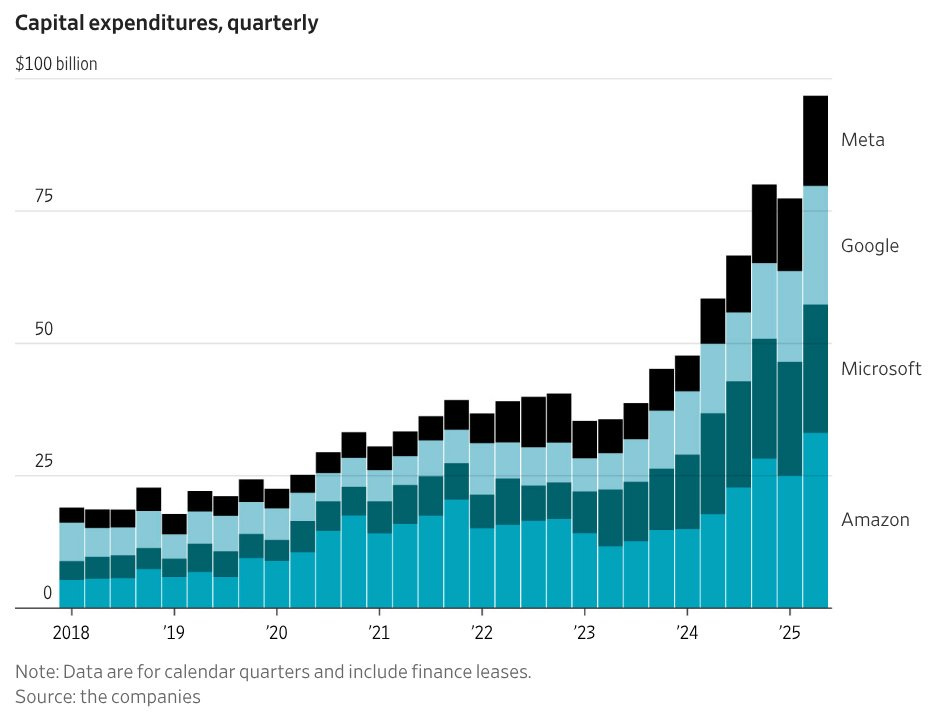

Here’s what this looks like over time. You can see we’re at $100B/Q right now and with Q1 at 75B to get to $500kb, we’re going to see this get over $120B here soon.

$500B in Context

To put that in context, over the last 10 years, Amazon has spent $115B on fulfillment investment which felt like an insane amount of investment. Here in 2025, we’re looking at 5x that in a single year for GenAI. We’ve never seen consumer and corporate demand grow so fast, the Tokens are the best indicator of that. That demand is causing these companies to invest unprecedented amount of treasure into building out infrastructure to keep up - which sets us up for another leg up in growth of Token generating capabilities, model improvements, use cases and the flywheel loop should cause more consumer and business adoption.

That’s what went on with the public AI companies this week as they announced their Q2 results. Now let’s check in on the private companies.

OpenAI and Anthropic News

The information had two pieces this week. First they dropped that OpenAI has hit a $12 run-rate and has 700 WAUs here.

Then they followed up with an article that OpenAI has raised north of $8b on a goal of $7.5b (over-subscribed) and they are telling investors that by the end of 2025, they will hit a $20b run-rate.

Anthropic news

Not to be outdone, it was disclosed that Anthropic is at a $5B run-rate now and is kicking off a $3-5b fundraising. If you’re wondering where all this money is going - go back and review the Capex table above ;-)

Public and Private AI Company Conclusions

What we learned this week:

AI usage is huge and accelerating

Token using is doubling m/m as usage goes up, models get more complex, prompts get bigger, inference runs longer, agents do more stuff

AI infrastructure companies are going to meet that challenge with an unprecedented investment in infrastructure to support it to the tune of $500B in 2025.

My theory is that one way to monetize all this is going to have to be commerce.

Now back to our regularly scheduled highlights of Agentic Commerce news.

Agentic Commerce News:

Chrome Adds AI Store Reviews

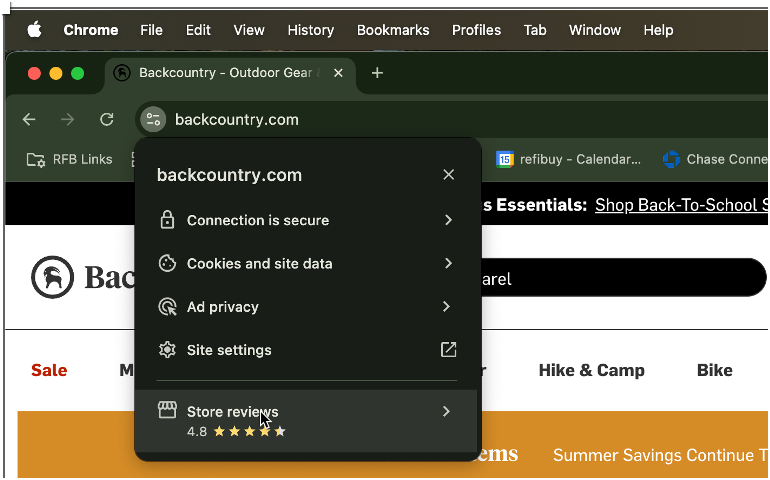

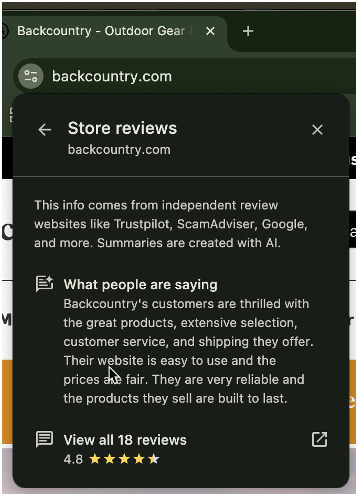

Google announced that Chrome has a new feature called AI store reviews. The way it works is you click on the little slider in the address bar at any ecommerce site (backcountry.com in this example:

and you can see a summary of Store reviews at the bottom. When you click on that, the menu flips to this: (this is the AI part)

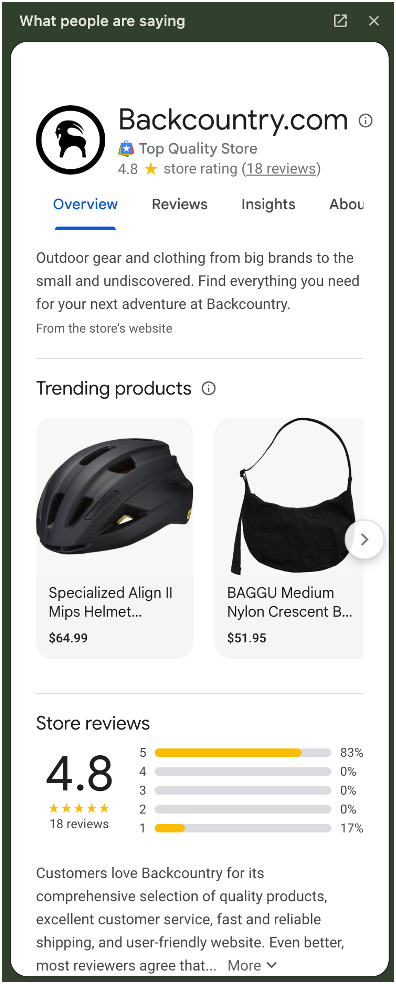

Finally, if you hit the expand box at the bottom, it opens up a completely AI generated side panel in chrome like this: (interestingly this is how all the agentic browsers behave)

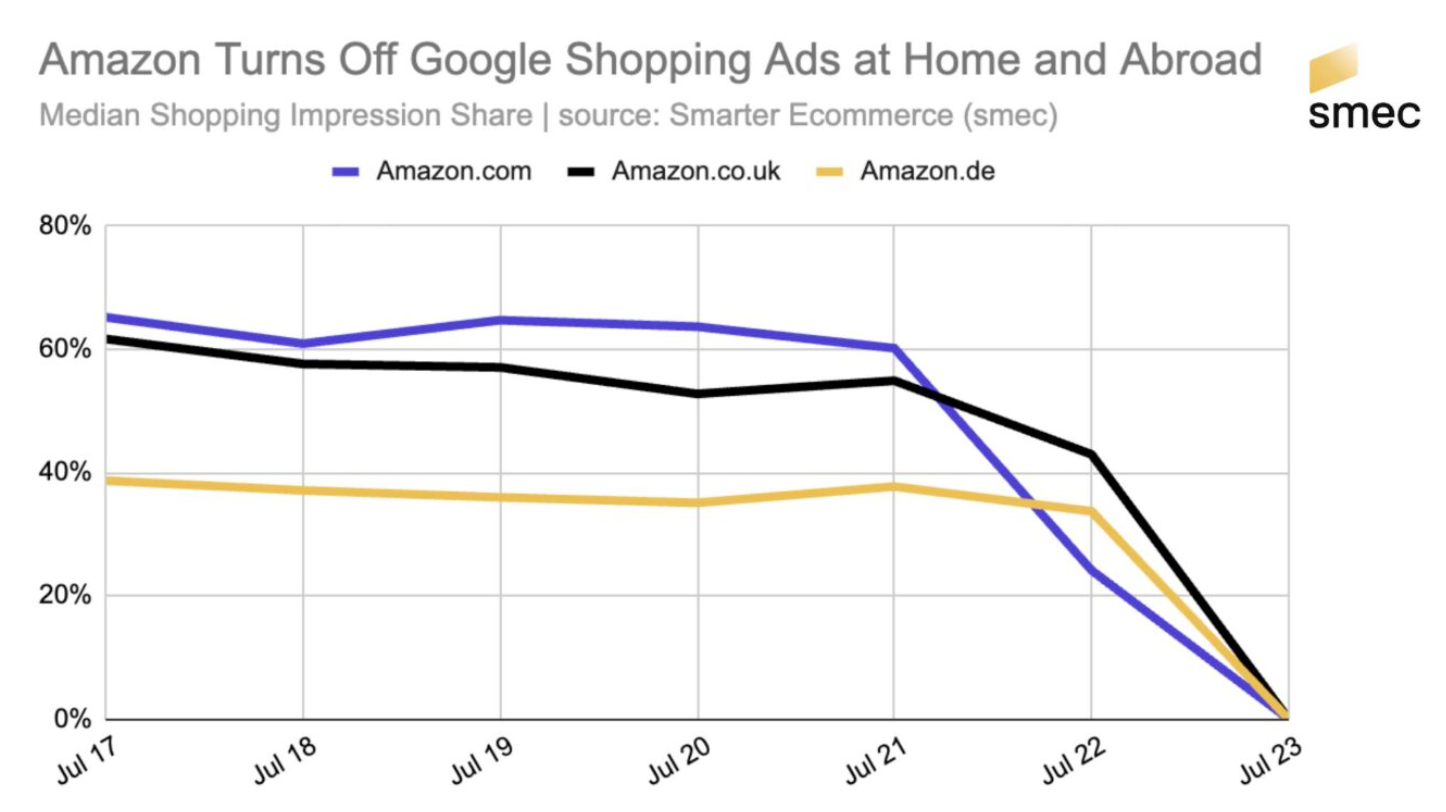

Amazon and Google Battled it out this week

In Q1, for 48hrs, Amazon pulled all their ads from Google Shopping, then they came right back. This week, we saw them do the same thing:

I saw some posts saying it’s ‘back on’, but I don’t see any third-party data analysis on that yet and I did some sample queries and it looks like Amazon is still out as of 8/2 to me.

There was lots of speculation on this, I think this is Amazon building Agentic Walls so that all of their product catalog and sales rank data

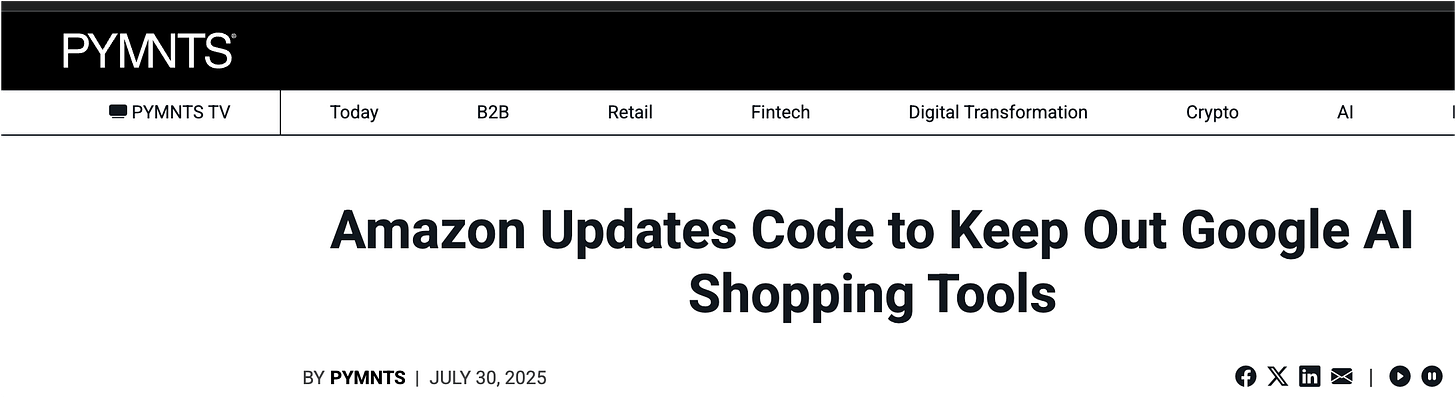

Amazon Blocks All Agents

On top of that, Amazon has implemented systems to block Perplexity, Google, OpenAI and other agents. Details here.

Agentic Advice from Google

John Mueller at Google is big in the SEO world and is one of Google’s people that shares a bit of what’s going on. In this LinkedIn post, he pointed to a test done in the EU across 50 top retailers that found most of them are accidentally blocking Agentic shopping agents. John suggests the most rudimentary thing you can do is make sure you have the digital doors open to customers using Agentic agents.

Good Agentic Reads for the Weekend:

Here are some good articles to round out the week’s Agentic Shopping happenings:

My Total Retail has a good piece here, urging retailers to think about how to differentiate in an Agentic shopping future.

Our Agentic payment friends at Nekuda had a deep piece on the role of headless commerce in a headless internet.