FLASH: Microsoft Copilot Checkout Is LIVE!, Jassy in Davos Reactions and ChatGPT 'Take Rate' Confirmed at 4%

We have deep analysis and demos on all three Agentic Commerce news items....

Three breaking news items here to end the week:

Copilot checkout is live and we have the first demo you’ll see

Lots of confusion and discussion around - What DID Jassy say at Davos?

The Information broke the story on ChatGPT’s economics - at least in the Shopify Ecosystem

Upcoming webinar→

Before jumping in, we’re hosting a webinar Feb 4 at 1pm EST with Worldpay and Nekuda where we’ll be digging into the ACP/UCP protocols - PSPs, token faults, VGS, MNS and all the alphabet soup that causes lots of confusion, we’ll be unraveling all of that payment/processing complex gordian knot with the thought leaders at that side of the Agentic Commerce equation. Register here (zoom webinar with Q+A and will be recorded).

Let’s dig into the news…

Microsoft Copilot Checkout Live Demo

Thanks to my friend Juozas (Joe) on the pointers on this one. Copilot Checkout that was announced way back on Jan 8 (that’s AI-era sarcasm) is live for some users. For us, it’s a little spotty to replicate and you have to be logged into a personal account.

In this < 3min video I walk through the whole experience (my personal information is blurred out). It’s very Instant Checkout-esque which makes sense given they are both built on the ACP framework.

Andy Jassy In Davos Warms to Agentic Commerce?

This week all eyes have been on Davos Switzerland where all the business and government leaders are meeting to discuss, Davos-y stuff. Amazon’s CEO Andy Jassy was on CNBC and did a long-form interview with Jessica Lessin at The Information. Both interviewers held his frozen toes to the fire around Agentic Commerce, working with ChatGPT, etc. In the CNBC interview he dodged it all quickly, but he said a LOT more in the Lessin interview.

Split Opinions

I've had several people say Jassy said they are opening up the walled garden, but when I watch it I hear him saying the same line with different words that they are open to conversations or, in other words, "not saying no" (but they also aren't saying yes) while also subtly throwing Agentic Commerce under the bus and promoting Rufus. What do yo u think?

Transcript from the Lessin/Jassy Interview on Agentic Commerce:

"I think that it has the chance to make it easier for customers to find what they want. If you know what you want it's pretty hard to find a better experience than popping onto Amazon and searching and finding it. But the one place still where physical retail has some advantages in my opinion is the ability to to go in, not know what you want, ask questions, refine those questions, have somebody point you to different things. And I think agents are going to help customers with that type of discovery.

And it's part of why we've invested so much in Rufus, which is our shopping assistant, which has really gotten quite good. And I think that over time we will work with other third-party agents as well. I think today the experience hasn't been great yet. I think that a lot of these third party agents, they don't have your buying history, they don't [know] what you like. A lot of the information about pricing and the product is off.

But over time, I do believe that we'll get better. I also think there needs to be the right value exchange between the agents and between the retailers themselves. But I am optimistic that those will work out. We're having conversations with lots of people and I'm very bullish on Agentic Commerce.

We'll see over time how many people want to shop their retail on a generalized agent [like ChatGPT] versus where they go every day [like Amazon/Rufus]. ... And so I think a lot of people are going to choose to use our agent and then when we can find opportunities to make the experience right for customers with with more generalized agents, we'll have those conversations too."

If you’d like the watch the Video, it’s a great interview with much more than Agentic Commerce here→

ChatGPT Economics Confirmed! 4% Take Rate - a STEAL! Make it Rain…

Finally, Ann Gehan at The Information broke the story and got confirmation from Shopify that ChatGPT is charging 4%. This is what we had heard through the grapevine and frequently said “mid single digits” to reflect this, but it’s good to have confirmation. Note this is the Shopify price, I would guess larger merchants are negotiating specialized deals. Also, I’m assuming that 4% is NOT inclusive of payment fees which range 2-3% - so call this all-in 6-7%, we’ll call it 7% to be conservative.

Reactions to the 4%

Everyone I know in the payments world has said this is insanely high. Everyone that’s a merchant and paying ‘the Google tax’ or the ‘Amazon/marketeplace X tax’ has said…. WHERE DO I SIGN UP THAT’S INSANELY CHEAP!

Let’s look at both sides of that so the payments folks in the audience have a baseline.

Understanding Google Adwords Economics

To translate ROAS (Return on Ad Spend) into what I call a Take Rate (some use ACOS - Advertising costs of sales), you take the inverse. For example:

ROAS: 2 - 1/2 → 50% Effective Take Rate

ROAS: 3 - 1/3 → 33% Effective Take Rate

ROAS: 4 - 1/4 → 25% Effective Take Rate

ROAS: 5 - 1/5 → 20% Effective Take Rate

ROAS: 6 - 1/6 → 17% Effective Take Rate

and so on. Various benchmarks like this one, put ecommerce Adwords at 2.5-5 ROAS

So that gives us a Take Rate range of 20-40% equivalent (30% on the midpoint) on Adwords.

There’s a more complex CAC/LTV view that can make this more effective if your’e actually able to get people to stop using Google. But it’s though because Google shoppers tend to…go back to Google. Think of this as ‘directionally right’.

SEO (organic) traffic is free and tends to blend this down (which is why everyone is freaking out that it’s dropping precipitously).

Conclusion: Google has a 30% effective take rate.

Understanding Marketplace Economics

Back in the ChannelAdvisor days, I would set expectations for anyone selling on Amazon that their ‘take rate’ would be 15% including payments, but excluding any FBA and advertising. Many 3P sellers on Amazon spend 25-35% all-in with the 15%+10% FBA +0-10% ad boost.

The key to understanding why they pay this is you can’t look at these fees as taking out of profit. Instead, imagine two columns. Column one is ‘Sell it direct’ P+L and Column two is ‘Sell it on Amazon’.

The rows you are comparing are:

o Marketing costs - that lines up with the base take-rate and ad cost, you are getting access to Amazon’s hundreds of millions of consumers for that 15%. Selling direct (see Google section) is more like 20-30%), so Amazon is cheaper, leaving room for…ads!

o Shipping costs - The shipping costs line up with FBA and usually FBA is cheaper than ‘ship yourself’ because of Amazon’s scale

When you do that, merchants are frequently MORE profitable on Amazon vs. direct.

Want to Learn More?

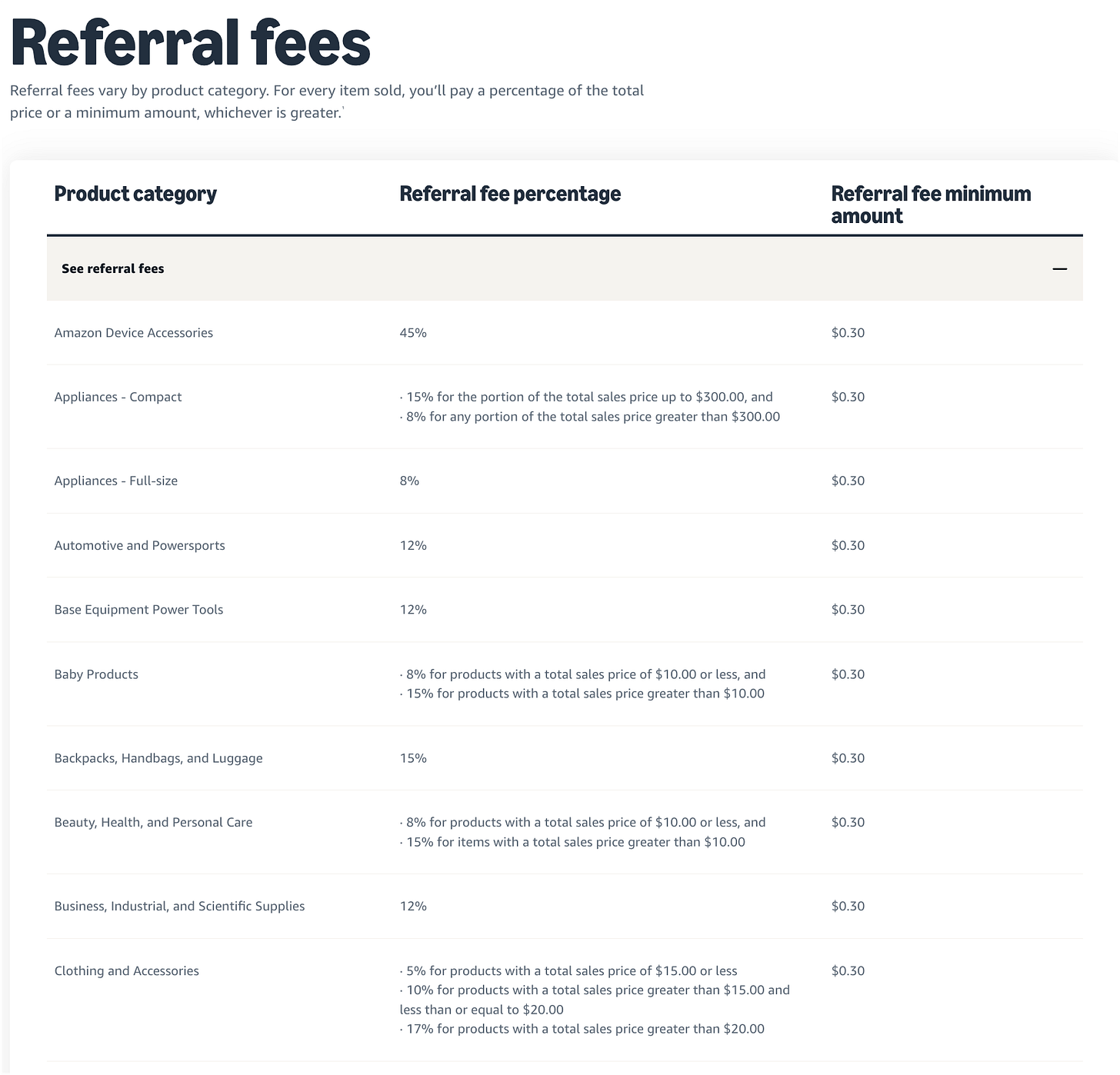

If this topic interests you, you can check this link for Amazon’s ‘Referral fees’ (Take Rate). They are very transparent and it’s a bit complicated, but you’ll see that for most categories it lands at the 15% with some under (electronics) and some over (digital goods)→

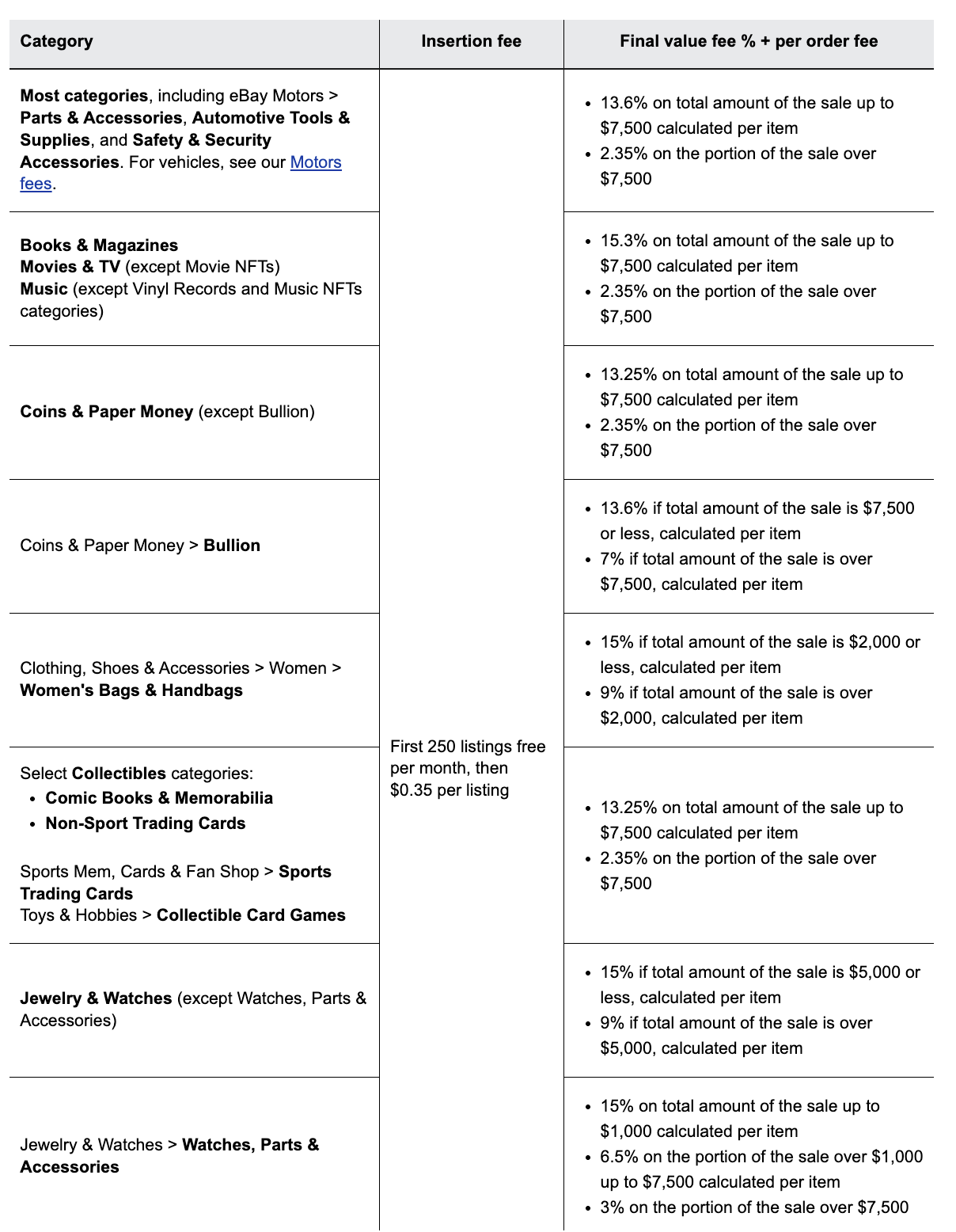

eBay is the OG marketplace and their fees are similar, detailed here and here’s a snippet. They call them Final Value Fees (FVF in eBay-speak) and they are insanely complicated because they are like a progressive tax.

For example look at jewelery and watches:

15% of amount up to $1k

6.5% on the amount $1k-$7,500

4% on the amount over $7,500

🤦♂️

Conclusion

If you’re used to paying 15-30%, 4%→ 7% is an insanely good deal and I have a theory that Sam Altman and team know this, this will put pressure on Google as they move $ over, are they going to charge 30% take rate on Google UCP Checkout? If not, whatever the delta is there, is the effective ad dollars they will lose in the transition (before ads on top).

Speaking of Ads, it also is designed to leave a TON of room on top for merchants to either discount (if they don’t have MAP pricing, which most do) AND buy ads and offer fast free shipping, this is going to be interesting is much more in-line with how the Chinese marketplaces do things - Alibaba’s Tmall has a similar model - they charge 2-5% take-rate and merchants spend a TON of ads and shipping promotions and discounts - this model puts the power of choice and dynamic markets into the hands of the merchant, very much aligned with ChatGPT’s ‘pro merchant’ messaging.

One thing I can guarantee at this point: Agentic Commerce Holiday 2026 is going to be CRAZY!

4% chatgpt charging for bringing traffic, i feel is great, given "take rate" from other channels

Just wondering how would chatgpt manage for 1000s of brands, when they can just show few options to a customer?

Really excellent breakdown of the take rate economics here. The comparison between ChatGPT's 4% and Google's effective 30% rate makes the value proposition crystal clear for merchantss who are drowning in customer acquisition costs. I've watched several ecommerce brands struggle with rising ad costs so this kind of shift in the economics could be transformtive. Dunno if Google will respond with lower rates but this feels like a major inflection point.