FLASH: Rufus Usage Surges 70% (Sensor Tower) plus...Early Black Friday Read from Adobe and Highlights from Salesforce's AgentForce Commerce Data

We have some great fresh data that tells us a ton about Rufus, and some new tidbits about how Agentic Commerce impacted Black Friday.

There are five days in what I call the Cyber Five which is Thanksgiving-CyberMonday and we now have two of the big 3 (TG/BF/CM) days in the books with CyberMonday as the biggie. Here at Retailgentic we’ve been combing the data for interesting tidbits you won’t find anywhere else. Let’s jump in.

First Time Rufus Data! (Sensor Tower)

Friend of Retailgentic, Ian Simpson at Sensor Tower, just shared some data we’ve been itching to get our hands on, because only they can figure it out - detailed usage and conversion data for Amazon Rufus (their internal AI assistant).

Ian’s a great follow on LI and you can find the OG post here.

There are three charts in there that are worth covering individually and in depth, but before 2 background items: Sensor Tower and some Rufus Reminders.

About the Sensor Tower Data

My understanding is that ST has a panel of a substantial number of consumers and through this panel is able to gather very detailed mobile device usage. Therefore this data is mobile app only, not desktop. The data triangulates that 55-60% of Amazon’s overall traffic is mobile and the rest desktop (40-45%), so this data is definitely directional of what’s going on.

These charts are all indexed to 10/1 and include Black Friday. Indexing puts the 10/1 trend at 100 and then shows adds/downs from that index to show Holiday trends against a non-holiday period (10/1-11/1 or 11/27 depending on your definition of when Holiday starts).

Rufus Reminders

While our primary focus here at Retailgentic is the ‘external’ multi-merchant Agentic Commerce Engines, Rufus is very strategic because of three things:

It’s Amazon - ‘nuff said

I believe we’re seeing the most ecommerce UX innovation out of Amazon in 15 yrs (if you don’t count ads which I don’t as they detract from UX) in Rufus in the last 6 months.

Amazon has a deep relationship with Anthropic and while it’s purely our speculation, we believe this is an interesting look at what Anthropic’s LLM models can do when married with a large corpus of ecommerce data. I think this foreshadows what we could see should Anthropic widen their focus to Agentic Commerce. Their current focus is clearly coding agents, not commerce.

Jassy on Rufus in Q3 Gave Us Hints…

As a reminder, Andy Jassy told us three things on their Q3 earnings call:

Rufus is significantly lifting conversion and is expected to generate more than $10 billion in annual incremental sales for Amazon’s retail business.

Jassy highlighted that around 250 million shoppers have used Rufus this year, with monthly active users more than doubling year over year and interactions up over 200%.

He stated that customers who engage with Rufus are about 60% more likely to complete a purchase than those who do not, which underpins Amazon’s projection that Rufus is on track to deliver over $10 billion in incremental annualized sales

Interestingly this 60% is almost in line with the Adobe GenAI conversion data. One data point is anecdotal, two gets us 2/3 of the way to a triangulation 🤔.

With that background, let’s jump into the delicious fresh data!

Chart 1: Shopping Sessions with Rufus Engagement

This chart shows us the overall number of sessions, indexed to 100 on 10/1 as a ‘baseline’. The blue line is sessions with Rufus, the gray is sessions without Rufus. You can see that prior to 11/15, the sessions were basically in line - no increase in Rufus usage. then as we hit the Holiday season on 11/15, Rufus starts pulling away dramatically but non-Rufus stays flat with only a bump around TG/BF.

If we compare the Rufus BF-surge which is 86% and the Non-Rufus BF-surge which was 16%, Rufus accelerated 70% in adoption.

Rufus Usage Accelerated 70% between 11/15 and Black Friday - Sensor Tower 11/28/25 Amazon Mobile App Usage Data

Why did Rufus Adoption Surge 70%?

I’m guessing that Amazon saw something in the data, as suggested by Jassy, that it was time to really expose more people to Jassy. In the first two weeks of November, I started noticing not only a ton of new Rufus features [coverage here: compare feature, Auto Buy and Price Tracker] and the user interface at the key consumer touchpoints of homepage, search, search engine result pages and product detail pages are sprinkled with features and links that ‘engage’ Rufus where as before it was kind of hanging out all alone down in the button bar without an icon that made much sense to me. Also, I’ve been using this heavily for a year and it’s gotten significantly better even outside of the features added.

We don’t know the causality here, but in ecommerce if you see something increasing conversions a massive 60%, you are going to put that thing everywhere as fast as you can.

I am now asking myself, when does Amazon get rid of search 1.0 and then the search and even home page are 100% Rufus? If it converts better, why not?! (hint: I can give you $70B high-margin reasons).

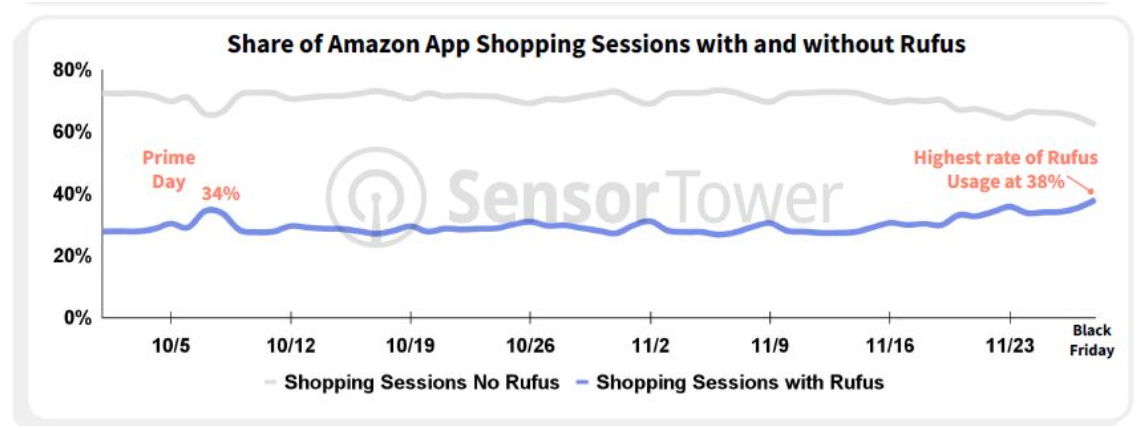

Chart 2: Share of Sessions With/Without Rufus

The indexed usage data is interesting, but doesn’t help us see a % - for example, Rufus could have been 2% of sessions and the surge could be to 3-4%. This chart shows us that we start at 70% non-Rufus and now it’s down in the 62% range or Rufus grew 30% share to 38% At this pace we should see the lines cross (Rufus usage over 50% of sessions) by end of Q1.

Chart 3: Rufus’ Influence on Conversions

This chart has a lot going on - the punch line is look at the gap between the blue lines (straight and dotted) and gray lines (straight and dotted) which shows the difference in conversion rate between Rufus sessions and non-Rufus sessions, look at that acceleration.

Rufus Conclusions

In addition to Jassy/Amazon, thanks to Sensor Tower, we have third-party verfiying:

Rufus usage has surged 70% since 11/15

Rufus is now being used in 38% of shopping sessions

Rufus has a significantly higher conversion rate that non-Rufus sessions.

Black Friday Early Read (Adobe)

Adobe is out with a Black Friday Early Read as of 6:30pm EDT:

GenAI Traffic up 600% y/y for BF

9.4% y/y growth (vs. 8.3% y/y forecast)

Based on performance so far, Adobe is bumping up their Black Friday forecast from 11.7b to 11.7-11.9b

10-2 were the top spending hours

Salesforce’s Agentforce Cyber-Five Highlights

Salesforce has a different set of data that is more global vs. the Adobe data that is qualified to the US, so not apples and oranges here.

The Thanksgiving data is prelim and the BF data was as of 5pm ET.

Agentic Commerce Oriented Datapoints:

Agents drive discovery for shoppers: Traffic from third party AI agent search channels has increased 300% in the first half of Black Friday compared to last year both globally and in the U.S.

Retailers who deployed AI agents on their websites this holiday season saw 9% YoY sales growth on Thanksgiving, compared to 2% growth for retailers without AI agents.

AI Customer Service - Consumers’ customer service conversations with AI agents surged 28% in the first 3 days of Cyber Week (Nov. 25-27) compared to the same time period the week before.

Cyber-Five Oriented Datapoints:

Thanksgiving global sales growth: Thanksgiving accounted for $35.6 billion in digital sales around the world (up 6% YoY) and $8.4 billion in the U.S. (up 3% YoY).

Black Friday sales on the first half of the day: The holiday shopping event has driven $30.8 billion in global sales (up 9% YoY), and $5.7 billion in the U.S. (up 4% YoY)

Black Friday updated projections: Global sales is expected to reach $80 billion (up 7% YoY) and $18.2B in the U.S. (up 4% YoY)

Next Update: Sunday Night/Monday Morning

Compared to Thanksgiving and Black Friday, the Sat/Sunday before CyberMonday is relatively quiet. We’ll be putting out a pre-CyberMonday post either Sunday PM or Monday AM to set the table for Cyber Monday.

Everyone have a great weekend and get ready for the big day!

Maybe Rufus will help conversion of their ad business, maybe Amazon Marketing Cloud could tap into that to drive that LOB?