Instacart Embraces AI, Scales Up Merchant Services: Case Study in Embracing Agentic Commerce

When a huge disruption comes along, you can either put your head in the sand or embrace it. Instacart's news shows what 'embrace it looks like.

This morning, Instacart is out with news of a variety of AI tools they are deploying for grocers. On the surface this may seem like just a couple new features, but reading the release and thinking about Instacart’s position, I think its a signal of a pivot or at a minimum smart a hedge. Also, since our topic at Retailgentic is how to handle this oncoming Agentic Commerce freight train, I think we can all learn a lot about instacart’s nimbleness here and how they are embracing the Agentic Commerce innovation vs. ignoring or fighting it.

First, let’s set the table for what’s going on. Our story goes through GSI Commerce if you can believe (for you digital OGs).

Instacart’s Brief History to This Point

Instacart originally positioned itself as a consumer grocery company, it would solve the hassle of grocery shopping for the convenience-oriented consumer and by all measurements they have wildly succeeded at this. 2024 full-year revenues were 3.4B.

That being said, industry analysts, including my podcast partner Jason Goldberg, felt that Instacart was more likely a GSI Commerce than an Shopify. If you don’t remember your e-commerce history…

The Tale of GSI Commerce

Now bazillionaire Mike Rubin, started GSI in as Global Sports Inc in 1998. The idea was - ecommerce is hard and kind of small so outsource everything to us and we’ll run it for you. As their name implies they started with a handful of sports brands and then expanded into Dicks Sporting Goods and other non-sports retailers. GSI handled the front end webstore and also built out a robust fulfillment center capability.

Ultimately, seeing the writing on the wall Rubin cleverly sold GSI to eBay in 2011 for $2.4b

Why did Rubin sell? Turns out by 2011, it was pretty clear:

Ecommerce isn’t a fad, it’s not a side business

Digital IS the business

Having someone else control this is a huge mistake, because it’s so important

Thanks to clever 8-10yr deals that were very hard to get out of, it took a while to unwind. eBay branded it eBay Enterprise, the front-ened closed, and then PE (I think) merged the back-end stuff with Innotrack and since 2016 it has operated as Radial, a shadow of its former self.

The Short Tale of Shopify

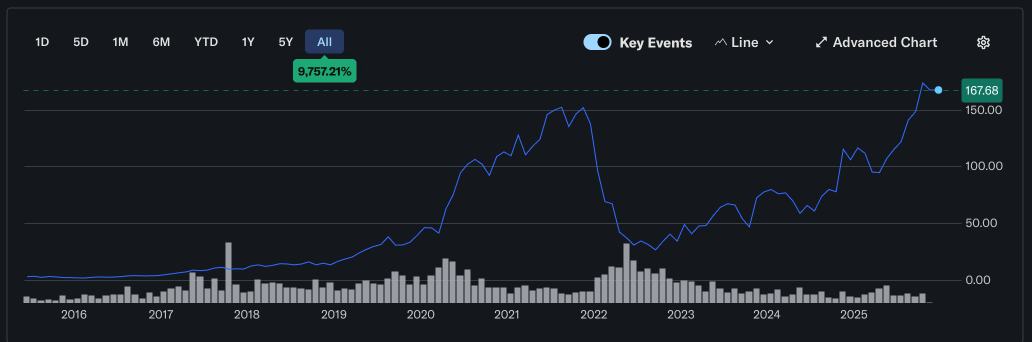

Tobe was building a snowboard store, couldn’t deal with the open-source tools and decided to build his own SaaS solution. He realized he was onto something and built it into a $225B company over the last 19yrs. His mantra of ‘arm the rebels’ has helped them grow from super small SMBs to now the largest stores are evaluating Shopify+. If you can’t tell on that screenshot, the ROI on the Shopify IPO is 9,757%

Moral of this case study: Be Shopify, not GSI

Back to Instacart…

If you are CEO of instacart, you know you don’t want to be GSI. The analogy meaning your grocery partners leverage you to on-ramp into digital and then built out their own capabilities. Sure enough this is critical enough you have Kroger, Walmart, Target, Whole Foods (Amazon now) either breaking out of staying in-network while building their own robust DTC capabilities.

The lesson learned from GSI is - what if instead of fighting this, GSI embraced it? What if they ended up unbundling all their pieces and if one of their customers wanted to use Shopify+ or Demandware, sure, we’ll help you do that, but don’t you want to keep our fulfillment? What if GSI had pivoted into a captive ‘all or nothing’ system and instead built a component-ized ‘use what you want’ system? What if they offered a RMN capability, Payments, streamlined checkout, web hosting, so-on and so-forth. GSI could have captured a huge portion of Shopify’s now $225B market cap business. What if they got half. There’s an argument that GSI blew a $100B opportunity.

If you’re instacart’s CEO, you know this, he may not know the GSI case study, but there’s this constant dance to keep the grocer’s in-system. The best way to do that? Do what I call ‘split the binary’ - instead of two choices: in-system or out-of-system, what if there’s a third option…

Instacart’s Expanding Enterprise Business

In 2019 Instacart tested ads and in 2020 they rolled out their self-service ad platform. This is now 30-33%, more than $1B in revenues and while I haven’t done an analysis, I’m sure it drives the lion’s share of margins for the company.

On the surface this may seem like this doesn’t help the grocers, but it does. The way it works:

Grocery partners opt in to be in the ad network

Instacart then gets brands to advertise in a variety of places - mostly on the top of funnel discovery and then ‘in cart’ -e.g. Add another quaker oats snack and get a $20 coupon

Instacart shares back to the Grocer a % of the ad sales which is pure margin to them - no sales, no ad serving, just ‘free margin’

Instacart Caper Carts

In 2022 to help grocers with the in-store activities, Instacart launched the clever Caper Art. It’s a technology-filled physical shopping cart that has a screen for your grocery list (and in-store ads!) The carts use AI to scan items as they go in the cart, so your checkout is basically syncing with the register and paying or I guess you could just-walk-out.

Instacart Storefront Pro

In November 2024, Instacart launched Storefront Pro which is basically the unbundling or private-labeling of their store technology for grocers that want to DIY. This is smart for two reasons:

If someone wants to leave the whole network, they can still be a customer

It expands your TAM to people that want to stay DIY and wouldn’t be a customer at all in the ‘full stack or nothing’ model.

Instacart’s Announcement Today

That brings us to today’s announcement. You can read the details here.

Let’s start with the CEOs quote, which I found interesting:

“It’s taking everything that we’ve been building for retailers over the last decade, and it’s bringing it into the AI era,” Rogers said. “It’s really about putting enterprise-grade AI tech in every grocer’s hands, whether it’s a small, local independent or a national chain.” - Chris Rogers, CEO, Instacart

My read of this quote: We’re not going to be GSI, we’re taking a run at being the Shopify for grocery and AI is the time to really lean in on this.

Instacart’s Announcements

All of these are under the umbrella of Instacart Enterprise - what I would call their merchant services offerings.

Agentic Commerce: Through partnerships with leading generative AI companies, Instacart is helping shape how grocery shopping works across the next generation of digital agents, ensuring retail partners are well-positioned as AI-driven commerce evolves.

Cart Assistant: A white-label, AI-powered shopping assistant that delivers personalized, conversational support across retailers’ online and in-store channels. It learns from each interaction to make grocery shopping easier and more intuitive. Sprouts Farmers Market will be the first to launch Cart Assistant on their website, apps, and in-store through Caper Carts.

Catalog Engine: With Catalog Engine, Instacart helps retailers build smarter catalogs enriched with nutrition, ingredient, and product data, powering more accurate and personalized shopping experiences across every channel.

In Store Intelligence: Tools like Store View give retailers real-time visibility into shelves. Using AI and computer vision, Store View turns shelf images and video into insights that improve inventory accuracy, reduce out-of-stocks, and keep products available.

Agentic Analytics: A new analytics layer that turns retail data into instant, actionable insights. By layering Instacart’s agentic AI on top of a retailer’s existing data, it helps teams ask complex questions and get clear answers fast, driving smarter, more efficient decisions.

Conclusion

The Agentic Commerce moment in time is a huge risk for the original D2C Instacart business model, it’s going to get easier and easier for grocery stores to ‘go direct’ and break out of the network. If Instacart loses the ‘front door’ (instacart.com or the app) and people use ChatGPT or gemini for their grocery shopping (meal planning is one of the top activities), they are toast. Instead of fighting this possible, maybe even inevitable outcome, they are using the disruption to accelerate into the business of powering grocers by releasing a suite of 5 capabilities that will enable grocers to succeed in the Agentic Shopping area. Giving them a Rufus/Sparky like assistant, helping them dust up their catalog (brilliant idea! 😁) providing analytics/GEO and finally, starting to tie it into the store.

Be Instacart, embrace Agentic Commerce, don’t fight it or pretend its not happening. It’s happening faster than anything we’ve ever seen, the longer you wait, the worse it’s going to be and harder it will be to catchup.

thanks - it came to me thanks to Jason Goldberg

Great article! Product unbundling is going to be absolutely key with AI making software creation more accesible