Agentic Commerce News for the Week of 12/7-12/13 (Week 50/52): Morgan Stanley Agentic Commerce Reports Deep Dive Plus Two Bonus Pod Recommendations

Morgan Stanley Brings the Agentic Commerce HEAT - 🔥🔥🔥

Before I jump into some interesting survey data and detailed analysis from Investment Bank Morgan Stanley, two quick reminders:

NRF - Attending NRF and want to talk Agentic Commerce? We’ll have a big team there and are going to be in booth 8105 in the Innovation Hub. We’d love to meet, fill out this form and we’ll get it scheduled. Retailers, brands, potential partners and agencies are all welcome.

Podcast - Don’t miss this week’s podcast - I had a great conversation with Luca Fiaschi, he is the co-author of a really interesting research paper in partnership with Colgate-Palmolive where they use synthetic (GenAI/LLM) to get feedback from them. It’s very cool and my mind was racing thinking of different ways this technology could be applied. Here’s the paper:

“LLMs Reproduce Human Purchase Intent via Semantic Similarity Elicitation of Likert Ratings.”

What’s a Likert Rating? I asked the same thing!

Morgan Stanley - A Deep Dive!

In usual weekly summaries I give you a cornucopia of updates - this week’s going to be different. There are two Morgan Stanley reports out recently that are really amazing. They trump all the other news - most of which are recaps of Agentic Commerce trends we all know and love. As a bonus, after the Morgan Stanley deep dive I have two podcast recos (but you have check them out AFTER the Lucia pod.

I’m particularly excited about these reports because we haven’t seen a comprehensive consumer survey since July.

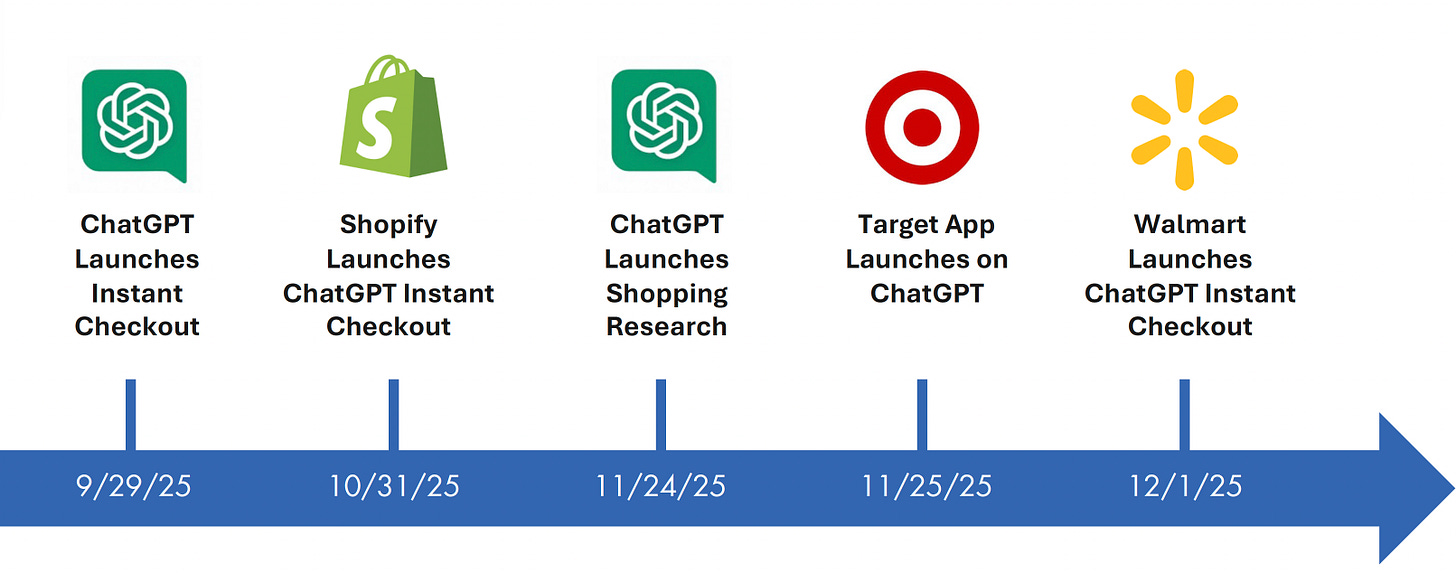

A LOT has happened since July - here’s the ChatGPT timeline:

On top of that we had:

Nov 13 - Google launches Buy for me

Q4 - A ton of Rufus innovations

Nov 26 - Perplexity/PayPal re-launch

I could go on, but you get the point.

The Morgan Stanley reports are:

Alphawise - This is Morgan Stanley’s regular consumer survey. Back in May, (way back in our 5th post!) I covered the Q2 report that had 2 questions that mentioned shopping and I was super-excited. In their Q4 report they have now added a TON of questions specifically around Agentic Commerce and they are branding that the “Alphawise agentic commerce tracker” YES! 🙌

Agentic Commerce ‘initiation’ - This Q they also put out a WHOPPING 97 page report that is extremely dense, very well researched and the most comprehensive analysis of not only what we write about here, but applying what we all know about Agentic Commerce and then they take that and apply it to the universe of brands and retailers in their vast coverage universe and do a SWOT-like analysis for them all. 🤯

Let’s dig in!

Morgan Stanley Alphawise Highlights

As mentioned above, the last data from this report was May and this chart was what we got:

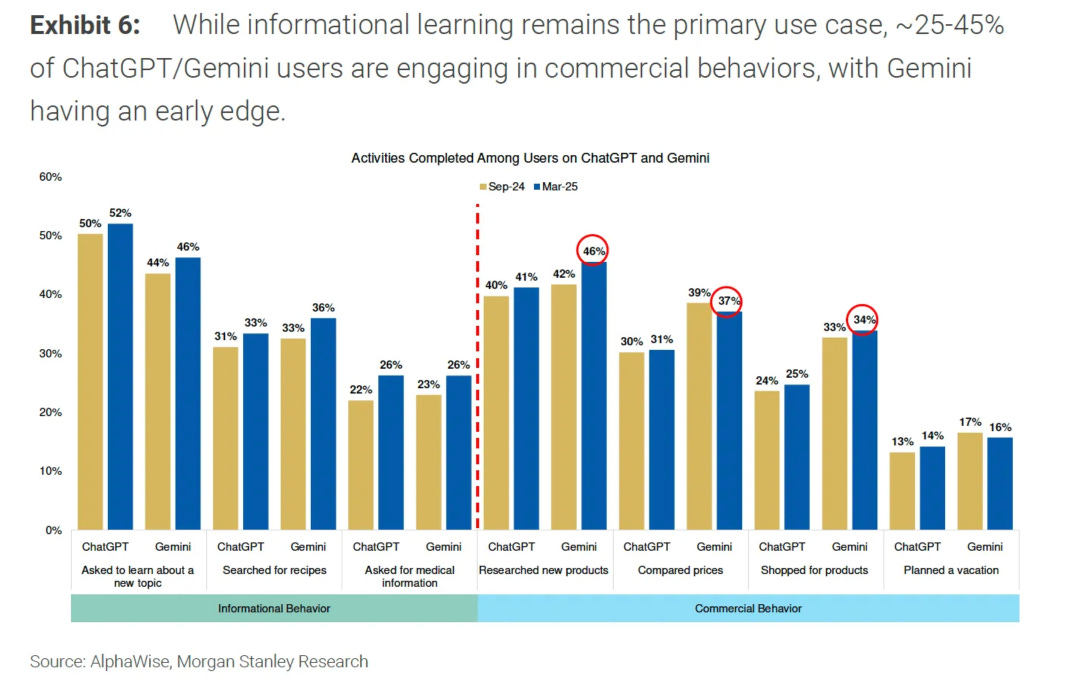

The March survey asked ~2000 consumers to check boxes on a bunch of different ChatGPT and Gemini activities they engaged in including: Researched new products, compared prices, shopped for products and planned a vaca.

This was exciting back in early Q2 because we got these inklings of demand for something new from the LLMs.

Flash forward to today and we have this chart:

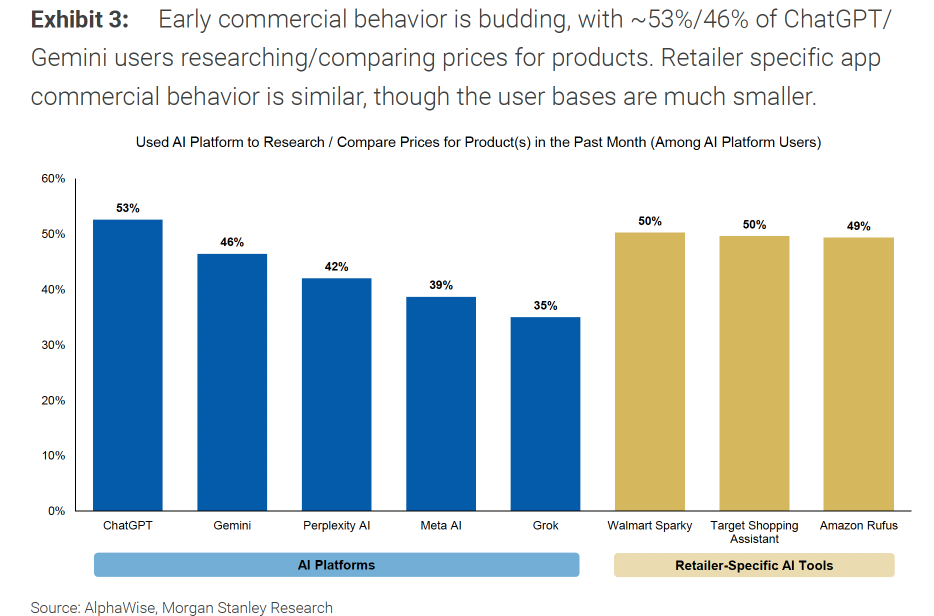

ChatGPT is 5% ahead of Gemini that’s 4% ahead of Perplexity that’s 3% ahead of Meta.AI thta’s 4% ahead of Grok (I noticed Copilot is MIA there). That’s a 18% lead between ChatGPt and Grok.

As part of this new Agentic commerce tracker they have a ton of data around Rufus, Sparky and the Target Shopping Assistant.

Sidebar: Can we just call this Bullseye instead of the ultra hip branding “Target Shopping Assistant”? Here’s my mock-up - Target call me, let’s discuss!!

I digress, back to the data, you can see that these are popular amongst the small audience using them (more on this in a sec).

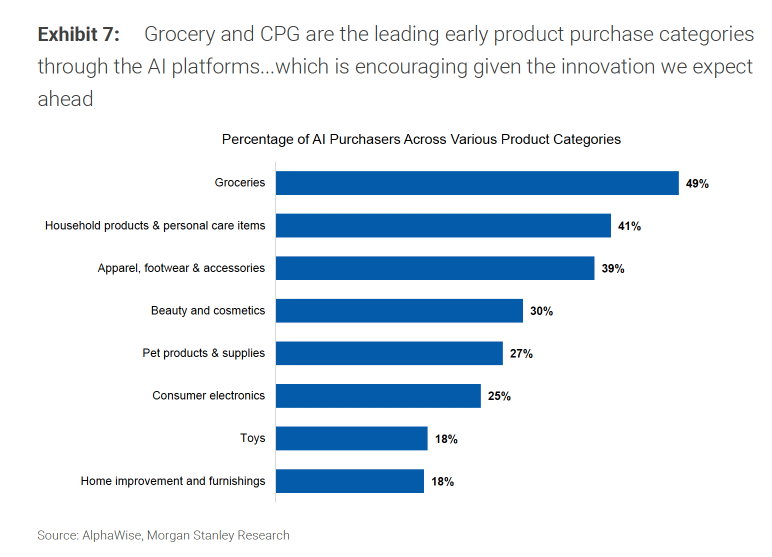

Category Data - Hooray!

One of the most frequently asked questions when I do executive sessions with brands and retailers is some indication of which categories are seeing the highest adoption. The only data on this is from July and it’s somewhat sparse. This new report has this great chart:

I’m shocked at how high Grocery is, but we keep hearing from the engines a big use case is meal planning and recipes which is such a natural jump-off point for grocery shopping that it makes sense with that context. There are two sides to this coin - we have come a LONG way in one year, but we have a long way to go. For example, where are sporting goods and Home improvement/furnishings has a lot of room to run. One thing’s for sure, next year is going to be LIT!

Other Highlights from the Report

Two other big datapoints that struck me from this report:

GPT, Gemini, Meta AI adoption ~2x-6x larger than that of retailer-specific shopping assistants like Amazon Rufus, Walmart Sparky, and Target Shopping Assistant (sigh).

30-40% of AI users are purchasing based on AI recs with 16% of Americans purchasing based on GPT and 3-4% purchasing based on retailer-specific AI tools.

On the first point, the data says that 45% of users ChatGPT’s shopping assistant and only 11% used Rufus (it and Sparky are basically tied at 11/10%). Target Shopping Assistant is at 8% - that’s where the 2-6x comes from.

If I’m Amazon, I don’t think it’s time to panic, but I’d be very concerned. The ‘we’re not going to play with ChatGPT use our on-site system instead’ strategy works if these numbers are within call it 10-30% of each other. 11%—→ 45% is 4X and Rufus has a lot of room to make up.

Since this survey was conducted (10/30-11/3), Amazon has added some killer features and more pdp-level visibility for Rufus. I suspect when we hear from Amazon about Q4 around mid-Feb we should get some really interested Rufus data, hopefully we’ll hear some kind of comparison between Q3-Q4.

Morgan Stanley Agentic Commerce: Initiation Report Highlights

This is the headline of this 97 pager (note: the red boxes are my addition).

Long-time listeners/watchers of the pods will have noticed that my go to questions, typically at the end, of how they feel about two predictions:

The PayPal prediction that by 2030, 25% of ecommerce will be Agentic Commerce

Bernstein’s (another Wall St firm), prediction that Agentic will lift (accelerate y/y growth) ecommerce 1.5-2.5 points annually.

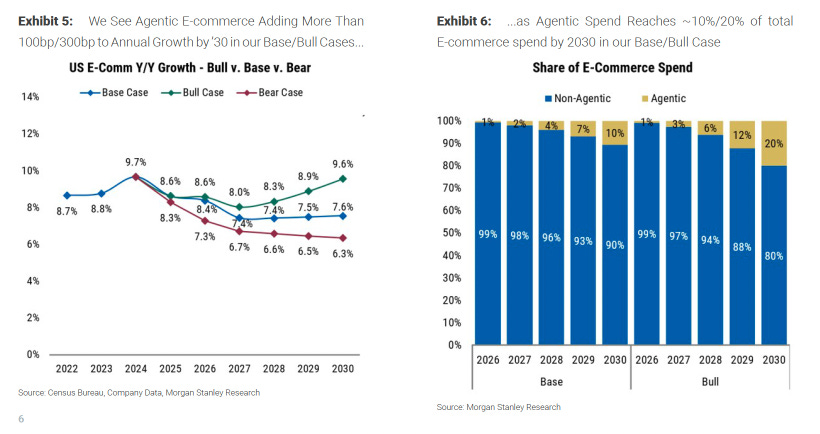

That’s why that $115B caught my attention - that’s the Base case. The upside scenario (Bull case) is a whopping $385b. That’s 6% acceleration in all of ecommerce!! Here’s the two charts that walk through this. Let’s dig in.

If you aren’t familiar with it:

Bull - The positive or the upside scenario (inspired by ‘animal spirits’). The high-side of a forecast.

Bear - The negative or the downside scenario. The low-side of a forecast.

Base - The ‘steady as she goes’ scenario. Basically what happens if nothing really changes. Aka baseline.

In this chart:

2025: Everything starts out about 8.6% y/y.

2030: Zooming out 5yrs to 2030:

Base: 7.6%

Bull: 6.3%

Bear: 9.6%!!

In the right chart we have share of ecommerce spend for the Agentic Bull case and you can see that when you apply that Bull growth rate, you get the $115B and that’s….20% of ecommerce by 2030. Note the base case is 10%.

BOOM! 💣

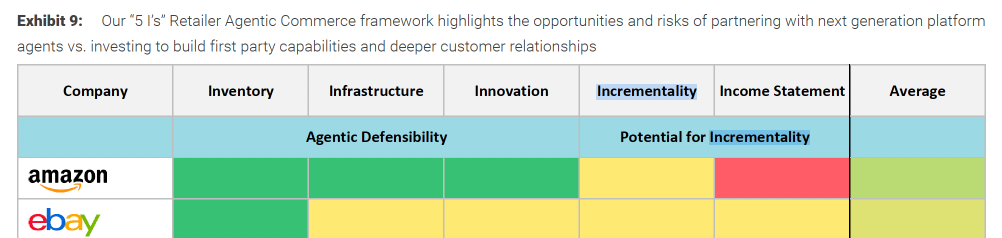

The Five I’s: Inventory, Infrastructure, Innovation, Incrementally, Income Statement

The other big highlight from this report is Morgan Stanley has come up with a framework, called the Five I’s that is somewhat self explanatory except two:

Incrementally - Does agentic ‘add’ to your business model or does it detract?

Income Statement - How ‘disrupt-able’ is the business model of the company (e.g. low margin value players more at risk than high margin high service-level companies).

Here’s 2 examples of hundreds in the report cutting across brands, retailers, RMN, marketplaces, social media and more:

Two Great Pods

With the Holidays coming up, maybe you’ll have some extra car time. here are two podcasts that are pretty meaty:

Benedict Evans: Will AI Be Bigger Than The Internet?

Back in August, I highlighted a megadedk from Benedict Evans here and you can download the latest and greatest here. (It was updated in Nov - minor mods) I recommend downloading it and giving it a flip before the pod, the pod kind of assumes you have a working knowledge of it. This one clocks in at just over 1hr.

Get your Geek on with Gavin…

Gavin Baker is one of my favorite folks at explaining the hardware side of AI. He’s an investor in semiconductors at a firm he founded called Atreides Management, LP. While this one clocks in at 90mins, it goes fast because Gavin is really engaging and great at explaining very complex concepts by boiling them down to first principles in easy to understand terms. The learnings/minute are extremely dense, so this one is well worth the time if this topic of any interest to you. It all ties together with Agentic Commerce so there’s connective tissue here for sure. My favorite part: Datacenters in space -wait till you wrap your head around that one. 🧐

It’s a Wrap!

That’s it for this week. Next week we have a special post and a special pod to end the year - stay tuned and Happy Agentic Commercing!

How to access the full version of the two mentioned Morgan Stanley reports?

Fantastic synthesis of the Morgan Stanley data. The 4x gap between ChatGPT adoption (45%) and Rufus (11%) is honestly pretty striking given Amazon's captive traffic. I've been tracking these agentic assistants since launch and the problem seems to be that shoppers already have a mental model for ChatGPT but Rufus still feels like "just another on-site widget". That $115B base case is conservative if even half the grocrey meal-planning use case converts, which tbh seems inevitable at this point.