Agentic Commerce News for the Weeks of 10/26-11/1 (Week 44/52): Amazon's CEO Comments + Q3 Earnings Analysis

Key phrases heard in the Mag7 Q3 conf calls: "compute starved", "significant backlog", "increasing capacity notably larger", "as fast as we can", "very aggressive".

Greetings Retailgentic’ers! First a friendly reminder: Only 27 days until Black Friday!

This week looked to be a slower one, but then:

Tuesday - PayPal surprisingly broke ranks with Google/AP2 and announced they are teaming up with ChatGPT, and implementing Instant Checkout / Agentic Commerce Protocol

Wednesday - We wrapped up our 4-part series by unveiling the Agentic Commerce Optimization (ACO) Playbook - thanks for all the comments and shares! GEO and AEO are out, ACO is IN!

Thursday - In our podcast with Caila Schwartz, she revealed Salesforce’s prediction that 21% of sales in Holiday 2025 will be AI influenced (a staggering $263B) AND that in the first half of 2025, GenAI Answer Engine Search traffic increased a whopping 119% y/y. She also let us know that LLM-generated traffic converts 700% better than social media traffic and 200% better than top converters.

Friday - At 11am we (with some help from our little agent friends) noticed that Shopify was live with Glossier on ChatGPT Instant Checkout!

Phew, that was just the super duper high priority stuff.

Other big news came from the big earnings reports and subsequent conference calls from Meta/Facebook, Microsoft, Google/Alphabet, and Amazon. We’ll go through the highlights of those calls and how they impact our Agentic Commerce World in detail and look for evidence we are in an AI bubble or everyone is building way way out in front of demand.

But first let’s start with the Agentic Commerce bomb that Andy Jassy dropped during the Q+A portion of the Amazon conference call. I think we are going to look back at that moment as the important thing that happened this week, but #ItsComplicated, so let’s dig in and see what he said and make some educated guesses reading between the lines.

Amazon Warming to Agentic Commerce!?

In the second question from last on the Amazon call, Wall St Analyst, John Blackledge, with TD Cowen asked this question. One that I think everyone in the Agentic Commerce World wanted to know the answer to:

How does Amazon think about agentic commerce going forward? And how do you think Amazon will serve customers using agents to purchase goods on Amazon in the future? - John Blackledge, TD Cowen

First, thanks to John for asking this question!! 🙌 I’ve been wondering the last 2 calls why the heck hasn’t anyone asked the Agentic Commerce question so we can get some clarity of what Amazon’s thinking is here.

Jassy’s answer to this is really really interesting, important and complex, so I want to take some time and parse through it with you. It’s 5 paragraphs long. I’m going to ‘play it back’ from the transcript and ‘pause’ to inject commentary and analysis. I also want to hear how you interpret things because the statement can be taken several different ways. I’ve taken the transcript, marked each paragraph with P1-P5 and replicated it exactly in block quotes.

All these quotes are all from Andrew Jassy, Amazon, President, CEO & Director

P1: I’m very excited about -- and as a business, we’re very excited about in the long term the prospect of agentic commerce. And it has a chance to be good for customers, it has a chance to be really good for e-commerce. And I think if you’re -- if you know what you want to buy, there are a few experiences that are better than coming to Amazon. But if you don’t know what you want, it’s -- physical store with a physical salesperson still has some advantages. Obviously, lots of people do it on Amazon all the time. But you very often want to ask questions and help -- get help narrowing what you’re going to look for. And as you keep asking new questions, having a whole bunch of different options presented to you.

P2: And I think AI and agentic commerce are going to change the experience online where that experience where you’re narrowing what you want when you don’t know is going to get better online than it even is in physical environments.

Jassy’s logic here:

Agentic Commerce is interesting long-term (implies short term there are gaps, he gets into those)

If the customer knows what they want to buy - Amazon is the best

If the customer doesn’t know, what they want to buy - the store+salesperson has ‘some advantages’.

Because you often want to ask questions and get help, going down a branching tree of questions to understand your options.

Agentic Commerce can help replicate that experience online.

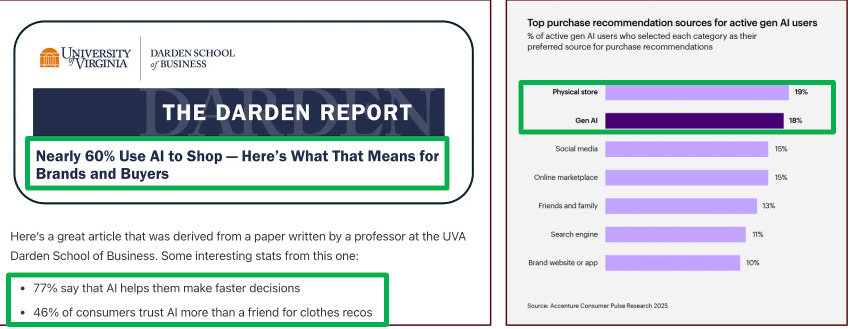

So far, I’m 100% in sync with Jassy, with the exception that I think this is largely here today. For my experience, the discovery/research process on Answer Engines that have pulled in Agentic Commerce via a product catalog (currently four engines do this: Perplexity, ChatGPT, Gemini, Copilot) is measurable better than Amazon and because the AI is 24x7 has a more knowledge than almost any sales rep possibly could. But don’t take my word for it. Here’s two third-party consumer behavior research experts that agree: (Note that GenAI is at parity with store

Note: the Accenture data was published in June, 30 days before GPT-5 and at least 4 months before the announcement of Instant Checkout. The report doesn’t say when the survey was completed, but to publish in June, I’d say in the March-May timeframe. ChatGPT has had like 6 major improvements since then.

Continuing on…

P3: Now we obviously have our own efforts here in agentic commerce. We have Rufus, which I talked about in my opening comments, which is continuing to get better and better and used more broadly. And we have features like Buy for Me where we will surface on Amazon, even items that we don’t stock that other merchants have. And then if customers want us to go and buy it for them on those merchants’ websites, we will do that. And both of those have been successful for us. But we’re also having conversations with and expect over time to partner with third-party agents. And I think that it reminds me in some ways of the beginning of search engines many years ago being sources of discovery for commerce. And you had to kind of figure out the right way to work together.

<RECORD SCRATCH>!!!

Let’s rewind that a tad→

But we’re also having conversations with and expect over time to partner with third-party agents.

Ok, they are having ‘conversations’ and expect ‘over time’ to partner with third-party agents.

There’s a LOT to parse in this one. If we think of the ‘possible set’ of agents he could mean here, it has to be one of the 7 Answer Engines: Perplexity, ChatGPT, Copilot, Gemini, Anthropic/Claude, Grok, Meta. Let’s handicap these:

Low probability: Amazon has no love lost with Copilot (compete on AWS), Gemini (have always had a frenemy relationship with Google), Grok (nothing there yet agentic commerce-wise) and Meta.

We are left with three med/high possibilities:

Med probability: ChatGPT and Perplexity

High probability: Claude

I’ve scored Claude highest because the companies have a very friendly relationship. We’ll get into the AWS side of that later, but at a corporate level, Amazon has invested $8B (that’s real money, even for Amazon) into Anthropic in convertible notes that have a reported/rumored current value of $13.8B. Anthropic’s last round was rumored to be valued at 183b. We don’t know if that’s pre or post money but let’s assume we’re looking at something on the order of $13.8B/$183B= 7.5%

What if the baller move here is that Claude and Amazon partner together to counter ChatGPT’s Agentic Commerce and Amazon powers Agentic Commerce in Claude?

The close number 2 is my probability matrix of the ‘mystery partner’ is ChatGPT. I do think having Walmart on ChatGPT Instant Checkout creates an interesting dilemma for Amazon. Is it enough to tip them over into joining? Amazon hates to lose.

Here is the the new information: They are having conversations and over time expect to partner with agents (plural) implying more than one.

Final thought, we know from the past 25yrs of watching Amazon/Google interact, that Amazon will frequently run a test or create friction in the relationship by suddenly pulling all AdWords or Google Shopping feeds. For example, today, Amazon is not showing up on Google Shopping in the US, but is in GS in international markets.

Continuing on…

P4: And today, search engines are a very small part of our referral traffic and third-party agents are a very small subset of that. But I do think that we will find ways to partner. We have to find a way, though, that makes the customer experience good. Right now, I would say the customer experience is not. There’s no personalization, there’s no shopping history, the delivery estimates are frequently wrong, the prices are often wrong.

I think it’s pretty tricky to claim that “agents are a super small set of referral traffic.” when you are actively and aggressively aggressively blocking all traffic from them, so they can’t possibly send you traffic because a. you aren’t in their database and b. you can’t possibly expect any traffic when not in the DB.

I’ve spent a fair amount of time with executives at large retailers in the last 6 months talking about this and my generous guess at what’s going on here is that Amazon has 1.6m people. It’s entirely possible that Jassy isn’t aware that Amazon is aggressively blocking agentic traffic and, therefore, has made the choice to receive zero traffic. At the same time, they do allow Googlebot in, but have recently stopped sending Google a datafeed. I say this because I’ve had this experience many times now:

CEO at big retailer: “Do you have any idea why our products aren’t showing up on ChatGPT?”

Me: “You are blocking their bots.”

CEO: Turns to team - Are we doing that?

Team: Shrugs

<Later>

Team member: Turns out that <someone in the MIS/IT dept> decided to block these bots without us being in the loop because they weren’t aware they are different than bad bots.

My point is - don’t assume Jassy is being tricky here or misleading us intentionally. There are many other explanations. Also, don’t assume Andy has used the latest versions of things. I also run across people that used ChatGPT in Feb, had a bad experience and don’t expect it to be that different now. Also, I meet people that when I say Agentic Commerce and am talking about the ‘embedded in ChatGPT integrated product discovering process with product cards that now lead to a cool checkout’, they are talking about Operator which is now confusingly called ChatGPT Agent. OR they assume all 7 engines are the same, they try Claude, because they’ve maybe invested $8B in that engine, and you don’t realize that their Commerce capabilities have really diverged.

Final thing I’ve noticed. This exponential timeline we’re on really messes with your head and takes time to get used to. Imagine you’ve been at Amazon since 1997 - 28yrs. That’s a heck of a run, but it’s linear. All those FCs take the same time to build each year. They get bigger, maybe they take a bit longer, time dilates. In my timeline, things are contracting - going the other way, speeding up, not slowing down. Why would you expect that to change? Why would you expect that if you check in on these ‘Answer Engines’ every 6 months or so, how much could they change in such a short time?

Ok, continuing on with that in mind…

Wait What??

The part of all this I have the biggest issue with is this statement: “Right now, I would say the customer experience is not. There’s no personalization, there’s no shopping history, the delivery estimates are frequently wrong, the prices are often wrong.”

Ok, I’ll give him the shipping estimates are frequently wrong on ChatGPT (ACP fixes btw). What tips me into thinking he’s not using the same experience as I/we are:

There’s no personalization - I find the personalization experience to be amazing because i’m logged in, have a paid ChatGPT account and it remembers everything due to the memory feature. To me memory is old, but looking back it was released broadly in Sept 24 and got a big upgrade in April 2025.

No shopping history - Wrong again, there’s an order history and I can see my complete shopping history and it remembers what I’ve searched for. After I searched for one men’s size 11.5 shoe, it’s defaulted to that size. That’s both personalized and history-based. Amazon can’t/doesn’t do this. 🤔

The prices are often wrong - Since GPT-5, this has gone down to a very infrequent problem, the ACP experience with the very frequent datafeeds will solve it the same way that Amazon 3P does. This is another non-issue.

To me, these three call outs he made are a huge flashing red signal that there’s a big disconnect here. Jassy is extremely smart and understands ecommerce very very deeply. It’s clear to me he hasn’t used the latest and greatest ChatGPT experience. I think the silver lining is, he will eventually. When he does, I think he will have a 💡moment.

Continuing…

P5: So we’ve got to find a way to make the customer experience better and have the right exchange of value. But I do think that the exciting part of this and the promise is that AI and agentic commerce solutions are going to expand the amount of shopping that happens online. And I think that’s really good for customers, and I think it’s really good for Amazon because at the end of the day, you’re going to buy from the outfit that allows you to have the broadest selection, great value and continues to deliver for you very quickly and reliably. And I think that bodes well for us.

Here it is hard to follow Jassy’s context, I can read it two ways:

We, Amazon, have to leverage Agentic to improve our experience **OR**

We, Amazon and they mystery potential partners, need to partner to make the customer experience better.

The ‘exchange of value’ phrase makes me lean towards the second context. It also makes me think -maybe they are stuck in negotiations? If ChatGPT wants 5%, for Amazon 1P that’s a tough pill to swallow, for 3P, it’s more than 33% of the margin. Walmart didn’t seem to have a hard time finding the ‘right exchange of value’.

Next, Jassy says: The exciting part of this is that Agentic Commerce are going to expand the amount of shopping that happens online. “ YES! 100% aligned, this, THIS, is what makes me so excited about Agentic Commerce, I believe the CX is already a next-level upgrade for shoppers and it’s going to get better and that CX will be the rising tide that lifts all boats.

I also agree, that if you are Amazon and you have the most selection and the best shipping and great prices, you should compete on THAT, not blocking the inevitable.

Exchange of Value

One thing to think about: “finding the right exchange of value” is a soft negotiating term. Let’s say you’re Amazon and ChatGPT would like your catalog. I believe Amazon’s top 2 priories are AWS and ads, marketplace is a distant 3rd and ‘retail’ is a distant fourth (it’s rational to prioritize by gross/net margin - highest to lowest).

Therefore, if I’m Amazon I say, “Ok, we will put our content in your network but here’s a package deal:”

3P is at 4% rev share

1P is at 3% rev share

You agree to a $100B AWS commit on Trainium3 for compute

We get to invest $3B into OpenAI

I’d ask for OpenAI to be avail on AWS as an API, but my understanding is Microsoft has this locked up, so probably not in the mix.

You agree that if you build an ad network, it includes the Amazon ad network in its network so our ad buyers have access to your inventory and we get to sell against your ad signals/users

Remember: Jassy’s brainchild at Amazon was AWS, it’s the horse that got hiim into the CEO chair. I doubt he’s doing a ChatGPT deal without some kind of a win for AWS.

If I’m ChatGPT I agree to the first three, the fourth would be a tough pill to swallow.

My macro point is I doubt this is a simple one-variable negotiation going on, there’s probably a complex packaged product negotiation going on. That’s ‘exchange of value’. If you just can’t come to terms on a single thing, you would say, we’re trying to get the economics to work or make the numbers work.

Conclusions from Jassy comments:

I don’t think (80% probability) Jassy is informed that Amazon is aggressively blocking bot traffic, thus causing the lack of referrals

I'm near certain (90%+ probability) he hasn’t used ChatGPT since the release of GPT-5, logged in, with a paid account, to experience the Research/Find/Buy cycle.

This feels disconnected from his final statement: “Agentic Commerce are going to expand the amount of shopping that happens online”, so he sees the potential.

I suspect he’s read a (probably an internal, 6-page typed narrative memo read silently in the first 30mins of a meeting) report that talks about the potential for Agentic Commerce 2-3yrs down the line, but hasn’t been hands on with ChatGPT shopping for about 8 ‘exponential’ months which is the equivalent of 24 ‘pre-GenAI’ months.

What do ya’ll think is going on here?

I’m going to make a prediction: We’re going to see Amazon on ChatGPT by July 2026.

What do Q3 Earnings Tell us about Agentic Commerce and are We in a Big AI Bubble?

Now let’s zoom way out to 30,000 feet. There’s lots of talk and fear that we are in an ‘AI Bubble’. I don’t have an opinion on that. What I do have an opinion on is people comparing this disruptive AI period of time to the internet bubble of 1998-2000. I was smack in the middle of that one and it was vastly different than this because most of those companies had very little to no revenue, just eyeballs. The internet bubble was built on eyeballs potentially turning into revenue.

The current AI market is very much built on quite solid revenue. We’ll use this opportunity to check in on that because every one of the companies had interesting things to say and the revenue numbers are mind boggling, and very much real and growing from real customers paying real big dollars and seeing value.

That being said, I do get that the amount of money these companies are investing is unlike anything we’ve ever seen and at some point the probability of hitting a ‘overbuilt’ state is real. What’s different though is today we have more signals because, well, we’re dealling with real revenues. Its easier to gauge revenue than ‘eyeballs→revenue’ - one less variable, it’s a big one too.

CapEx Spend

CapEx= Capital Expenditures. Any ‘hard’ item like a building, vehicle, datacenter, fulfillment center. In this context it’s all datacenter buildings that are being filled with accelerated compute (GPU) infrastructure. Mostly chips and infrastructure from NVidia, but also Google has TPU and Amazon has Trainium.

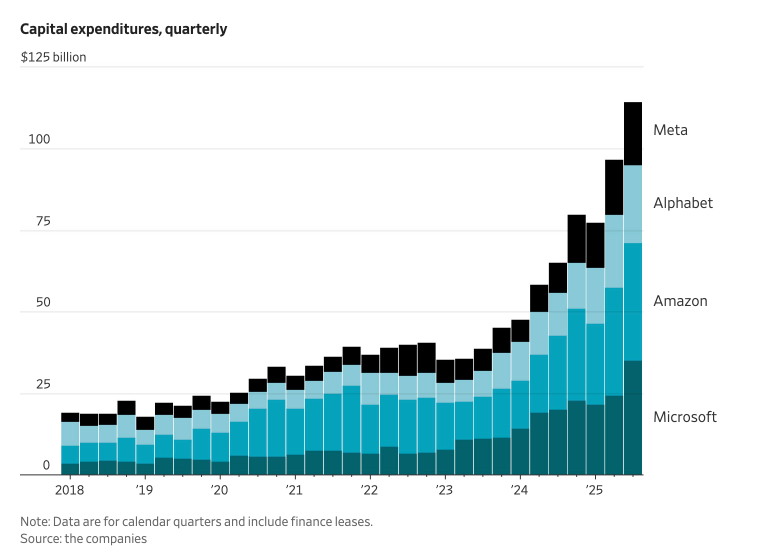

Here’s the historical context (from wsj article) now updated to Q3.

ChatGPT was ‘born’ Q4_22 and you can see one year later in Q4_23 after it improved dramatically with GPT-4, the big four hyper-scalers (Microsoft, Amazon, Alphabet, Meta) went from $35B/Q capex investment which was the level for years to where we are here in Q3 of 2025 at $115B/Q - a 3.3X jump in 2 years and a ~$500B/yr run-rate.

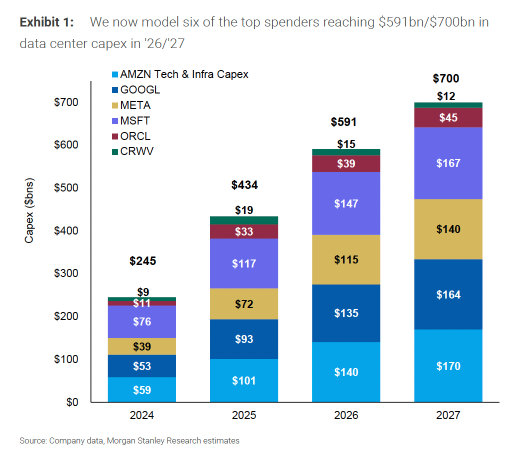

That’s the past, what’s the future look like? When public companies get past Q2 and into Q3, it’s tradition for Wall st. to start modeling out the next year and then from there you have enough trend data to make some educated guesses. In this chart Morgan Stanley took the Q3 actuals which gives us a solid view of 2025, the company’s 2026 guidance/statements and they projected it to 2026 and 2027.

You’ll see that, to be conservative, they show it slowing between 26/27 - maybe that’s wrong? The 24→25 jump is 77% y/y, the 25→26 jump is 36%, the 26-27 growth is 18%. What if the 36% and 18% end up being low? There’s a real chance we could crest $1T by 2027. 🤯

Comments from the Hyperscalers

Here’s my collection of what the CEOs of the hyperscalers had to say about all this:

“You’re going to see us continue to be very aggressive in investing capacity because we see the demand,” said Amazon Chief Executive Andy Jassy. “As fast as we’re adding capacity right now, we’re monetizing it.”

Microsoft said it would be operating with not enough capacity to power both its current businesses and AI research to the extent needed through at least the first half of next year, and that its cloud computing business, Azure, is bearing “most of the revenue impact.”

“We already are generating billions of dollars from AI in the quarter. But then across the board, we have a rigorous framework and approach by which we evaluate these long-term investments,” said Anat Ashkenazi, Google’s chief financial officer.

Zuckerberg also said that Meta’s current ads business and platforms are running in a “compute-starved state” while the company gives more resources to AI research and development efforts instead of shoring up existing operations.

Its capital expenditures—which already nearly doubled from last year to $72 billion this year—will grow “notably larger” in 2026, Meta CFO Susan Li said, without providing specific numbers.

Basically everyone is clearly saying that while they’re growing this aggressively, it’s not enough, the demand from customers, some of them are the Answer Engines, but most are enterprise customers, or in Meta’s case internal use cases improving their ad systems.

The Meta’s CFO and Zuck’s comments about “notably larger” and “significantly more” freaked out Wall St, so that one got taken behind the woodshed as Zuck’s pushing the bounds of what investors are comfortable with.

Here are some Highlights from each company and a little tracker I built here:

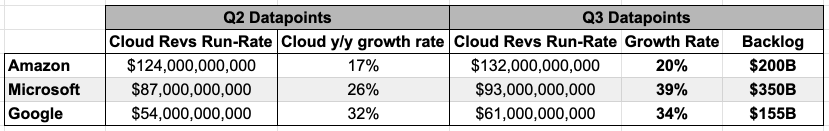

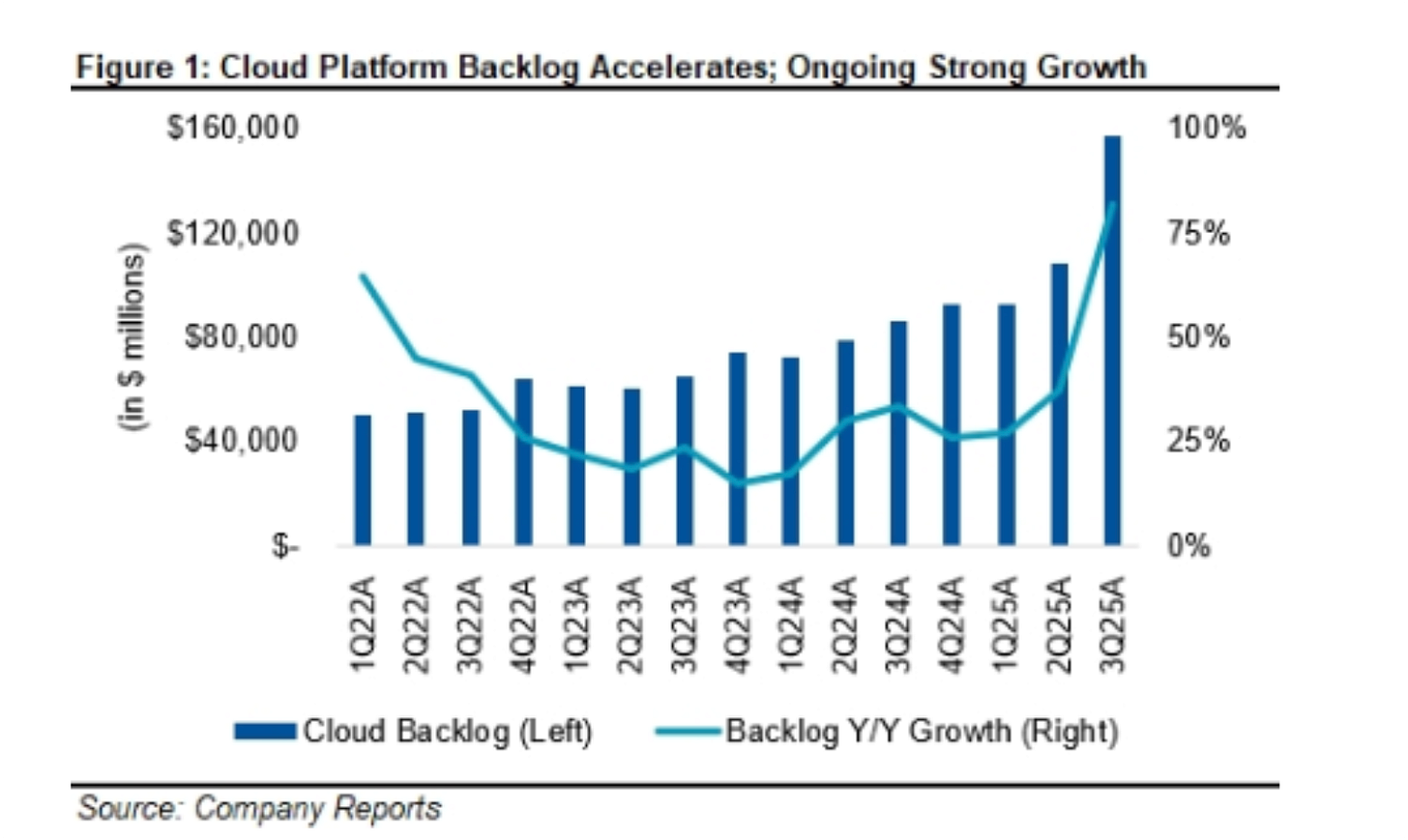

You can see the cloud revenue, REAL REVENUE, has accelerated in every case (I think my Microsoft Q2 datapoint is off, grain of salt that one, but google and amazon is solid), and look at the backlogs - this is customers that have signed up, want to go live, but there’s not enough capacity. That backlog between these 3 companies is $700B!

Amazon Highlights

Added 3.8GW of GPU compute added last 12 months, another 1GW in 4Q, double GPU capacity by 2027 +10GW!

Project Rainier - This is a project where they are building out trainium GPU DCs for Anthropic/Claude - 500k GPUs, scales to 1m by EOY

AWS Revenue growth accelerated to 20% y/y

Want to learn more about Rainier, here’s a good video→

MSFT Tidbits

OpenAI committed to $250B of incremental azure

Owns $135B of OpenAI

Bulk of revenue showing up in Azure demand

META Tidbits

Using AI internally vs. cloud

Margins coming down because expecting ‘meaningful’ capital and operating expenses due to company being ‘compute starved’.

GOOGL (Alphabet) Tidbits

AI Application Usage:

Remember Google has three ‘AI applications’: Gemini, AI Overviews and AI Mode (yes it’s confusing)

Google gave some interesting details on their AI usage:

Gemini 650m+ MAUs up from 450m in Q2

Processing 7b tokens/min

1.3T quadrillion tokens/m vs. Q2’s→ 980 Trillion monthly tokens (33% QQ growth)

AI Queries up 3x Q/Q (just gemini)

ALL AI ‘apps’ queries up 2x Q/Q

AI Mode has 65m DAUs with queries up 2x Q/Q

AI Mode/AIOs reached 2b users

Google Cloud Platform(GCP) Details

Cloud 34% y/y growth

Backlog grew 46% Q/Q - AI demand- $155B

2025 total yr Capex guided up to 91-93b

very supply constrained - will last until next year - across custom silicon (TPUs) and Gemini model usage (enterprise API I believe is what this means, not consumer)

GCP new customer growth was 34% y/y vs. Q2 which was 28% y/y

Conclusion and the Week Coming Up

My conclusions from this week’s news:

I think we’re going to see Amazon on ChatGPT Instant Checkout by July 2026

This is not an AI bubble like the internet bubble

Looking at all the data, the demand is currently so strong, the backlogs so big, there’s easily another 12-18mos of DC buildout at these levels or higher that will be consumed immediately

This is all being built off the first wave, what I’ll call the LLM wave, the agentic wave and reasoning saves are still working through the systems, there’s a world where I see this actually accelerating

The exponentially compounding timeline is my favorite timeline ;-)

What this means for Agentic Commerce, is what we’ve seen in 2025 is going to keep growing, could accelerate and I can see clearly through 2027 that there’s no end in sight to this exponential growth curve.

Scot - Fantastic roundup as usual.

You raised a point that is often overlooked: "I find the personalization experience to be amazing because i’m logged in, have a paid ChatGPT account and it remembers everything due to the memory feature."

I've found that experience on ChatGPT free vs paid versions to be quite different. When I was using the free version, there was a very small memory bank that was capped in the number of entries and I was forced to frequently prune memories so it would free up space for new ones.

With paid versions, I've found that there is a much greater memory quota (anecdotal reports suggest 10X-20X larger than free) without the need to free up space. Free version remembers a few basic facts but loses nuance quickly. The larger amount of memory with paid versions makes personalization feel more contextually intelligent. I agree that Jassy is unlikely to be using ChatGPT much and if he is, he's probably using the free version instead of the paid version, which may have shaped the response he gave.

Lastly, we have to remember that the vast majority of all LLM users are on the free version so features like broader memory and better personalization aren't as robust (for now, but I am sure they want to extend these features as widely as possible)

I know, I was surprised to see that so fast! 💨