Part I/III: What is GEO→ACO for Agentic Commerce and What’s the Goal?

We kick off a three part series with strategies and tactics any retailer/brand can implement to ride the Agentic Commerce wave in Holiday '25

Welcome to part one of a three part series:

Part I - (9/3/25) - What is GEO→ACO for Agentic Commerce and What’s the Goal? (**You are Here**)

Part II - (9/10/25) - The 13 Agentic Commerce Pitfalls (**You are Here**): with real-world examples.

Part IIIA - (10/21/25) Agentic Commerce Optimization Foundations: ACO 9-Step Sequential System, Canonicalization, Own the Product Card, Content+Context (here)

Part IIIB (10/29/25) The Agentic Commerce Optimization Playbook: 9 Easily Implementable Strategies and Tactics to dramatically improve your Agentic Commerce readiness, avoid the 13 pitfalls from Part II , and optimize the Seven Agentic Shopping Engines for maximum sales in Holiday ‘25.

This is going to be a fun series and something I’ve been thinking deeply about for the last twelve months so hopefully have some insights you haven’t seen before or thought about yet. Before we dig in, I want to talk about exponential growth, because it’s the underlying reason why our world is changing so fast somewhat out of nowhere and is a framework for helping you understand why this topic is incredibly urgent.

Note: In this series we will be showing examples of different brands and retailers in various contexts - both for what’s working well and what is not working well. These have been picked at random as illustrative at the time the screen shot was taken (9/2/25-9/30/25 window of time). This is a moving target and your experience maybe different.

Are You Ready for Exponential Growth?

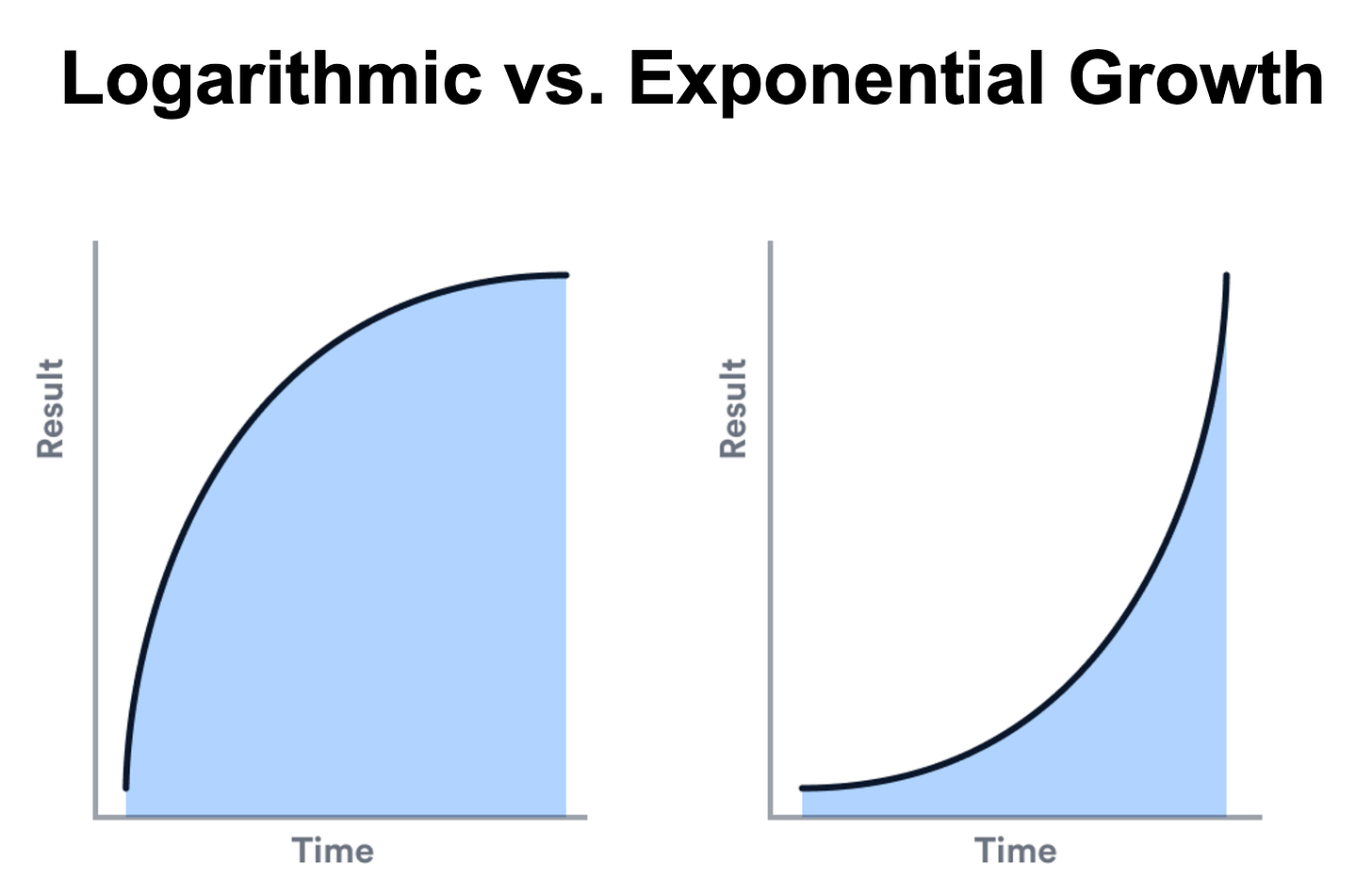

In our industry of digital commerce/ecommerce we’ve enjoyed huge growth for the last 30yrs going from 0% of retail in ecommerce to ~16% all while retail grew as well. But the growth has really flattened out - this is common for logarithmic growth - huge surge at first and then as you climb up the curve, you slow down. This is commonly called the ‘rule of large numbers’.

Why is GenAI different?

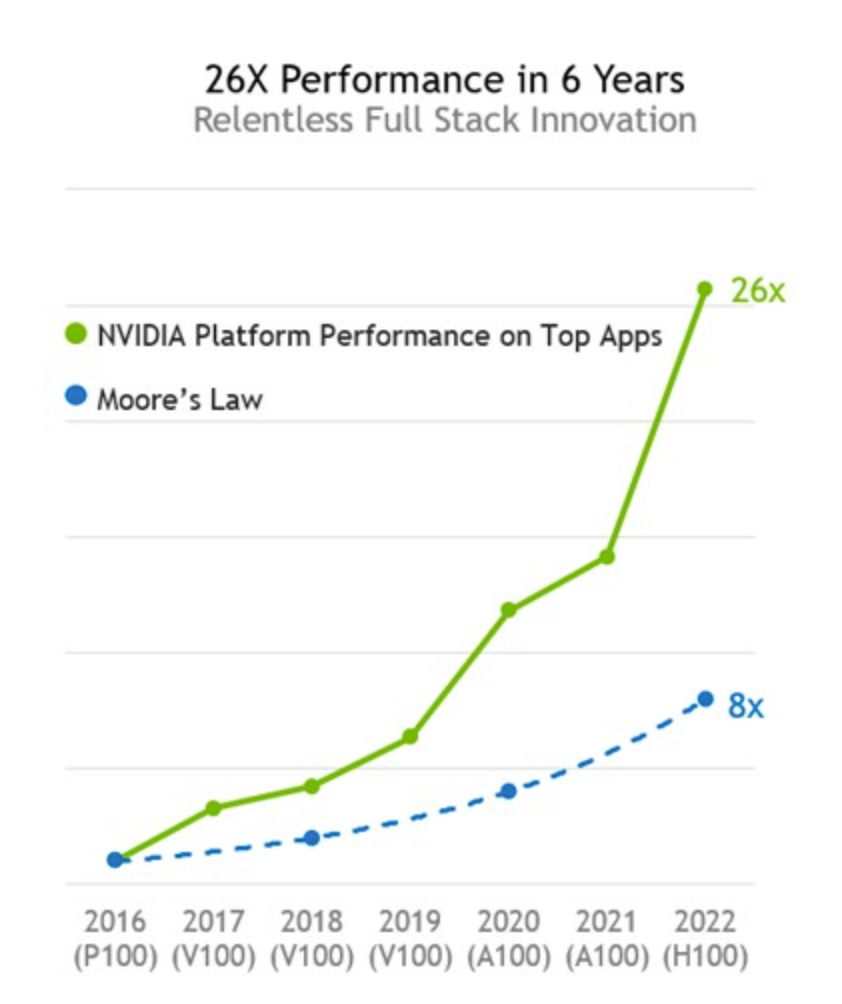

The underlying technology that ecommerce is built on, after you cut through cloud and all the other things, computing up until 2022 was built on traditional CPUs. Traditional CPUs follow Moore’s law - they double capacity ever 18 months. GenAI is built on GPUs and GPUs are doubling capacity every 6 months.

Your initial thinking on that is to think ‘ok this is like 3X because 18 months / 6 months = 3’. That’s close, but what it misses is the compounding factor. Here’s a good chart that compares CPUs vs. GPUs which shows that over 6yrs it’s actually 26X vs. Moore’s law that gets you 8X, the next cycle goes to 52x and 16x and so on.

As humans we’re not used to exponential curves. They are rare in the business world and we have a hard time processing them.

I’ll point this out as we go along on the GEO topic, but the reason I bring this up at the beginning of this series is point out that what feels like something that’s maybe a 10% thing today and could go to say 15% next year, is going to go to 20% in 6 months, and then 40% in another 6 months so in that year it will go from 15% to 40% if GenAI stays on this growth curve and all indications are that it will.

What is GEO?

There’s been hundred of thousands if not millions of posts about GEO, so I’m going to keep this part high-level and give you some starting points if you want to learn more.

A brief history of how we got here

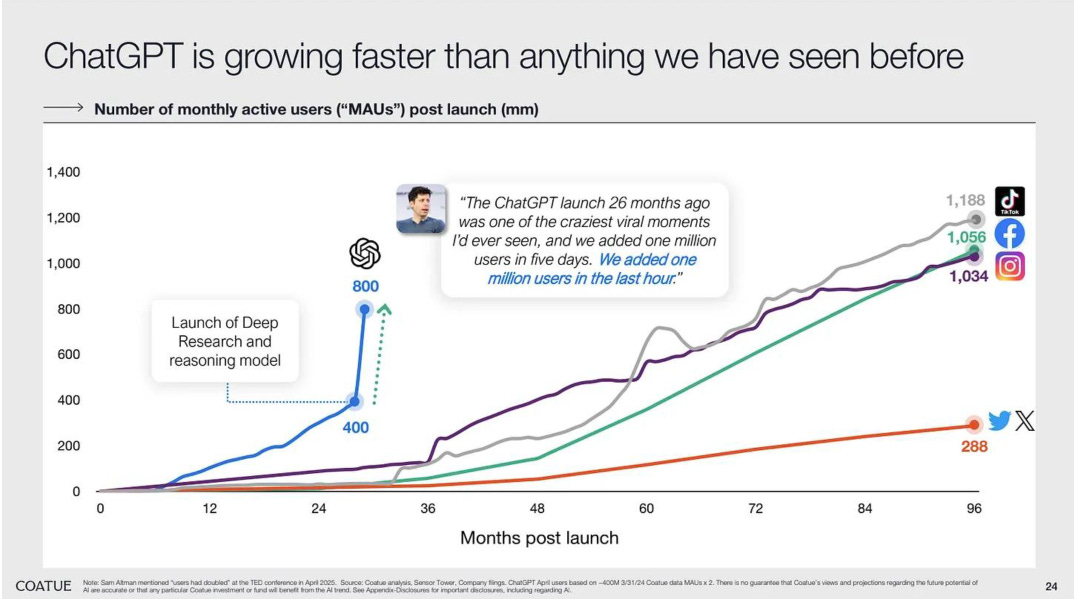

Perplexity was the first company to marry the power of a GPT-powered chat engine with a web index, creating what is now commonly called an ‘answer engine’ vs. a traditional search engine like Google. While Perplexity garnered a group of early adopter enthusiasts (👋 including me!), the idea and usage of an answer engine didn’t go mainstream until ChatGPT launched web search in October of 2024. To me, this marks the ‘birth’ of GEO. Web search plus Deep Research plus reasoning models propelled ChatGPT rapidly from 400m to 800m MAUs:

Q4 2024 - Metaphorical Canaries Start Dying in Coal Mines

With the Oct ‘24 launch of ChatGPT web search on a base of 800m MAUs married with the exponential compounding GenAI growth curve, by the end of Q4, there were early signs that the shape of traffic on the internet was changing faster and in a way we haven’t seen in the last 20 years since Google became the dominant search engine and thus the distributor of traffic on the internet.

The first sign was in Q4, Google took the unprecedented move of making 2 core search algorithm changes in one quarter.

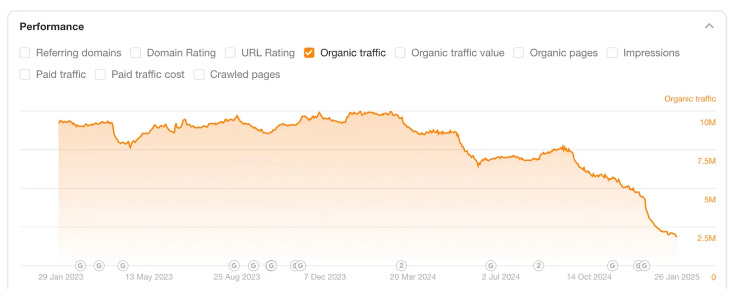

Then the real signal that things were changing came from Hubspot. Hubspot is an SMB CRM system that branded the concept of publishing content and thought leadership to drive traffic as ‘inbound marketing’. Hubspot is the king of traditional SEO and in January, a SEO guru discovered that Hubspots traffic was down 75%:

This prompted Hubspot to put out a pod where they claimed it was ‘by design’ (sure).

Then in early 2025, we saw the pile-on effect:

Feb 2025 - Grok adds web search

March 2025 - Claude adds web search

April 2025 - Microsoft’s Copilot added web search

Here we are today, September’25 coming up on the one year anniversary of ChatGPT launching web search in October of ‘24 with six GenAI Answer Engines (including Google’s family of GenAI offerings) taking share from traditional Google (ChatGPT, Perplexity, Copilot, Grok, Claude, Google AIO/Gemini/AI Mode) and dramatically impacting traffic trends across all categories on the internet, increasingly including ecommerce traffic.

What is GEO?

There’s a big debate on what to call all this, we won’t get into that here, suffice it to say I’m settling on GEO but that includes:

Answer Engine Optimization - AEO

AI Optimization - AIO

Large Language Model Optimization - LLMO

AI Search Optimization - AISO

Generative Search Optimization - GSO

I’m sure there are more, but these are the main ones I’ve seen. Some people will argue there’s lots of nuance in there blah blah, it’s all the same thing in my book.

What is GEO? In it’s simplest form, it’s understanding how these new GenAI powered web search engines answer questions, read your content and then using that understanding to optimize your content for maximum exposure (getting the most answers and citations.

How do SEO and GEO Differ?

If you want to go really deep on this, this SEO expert does a great job of laying out the basics of how traditional SEO and GEO are similar in some ways, but vastly different in others:

If you want the TL;DR, this infographic does a great job of highlighting the core differences across six different areas:

Hopefully that gives you a good foundation for how GEO came to be, what it is and how it’s different than SEO. It’s important to remember this is hardly a year old and didn’t really pick up steam until later in Q1 of 2025 and yet it’s already causing massive amounts of disruption.

Why are General GEO Monitoring Startups Hot Right Now?

In May, a16z had a piece about GEO and talking about many of the same concepts here, and introduced a market map of about 30 companies. Since then another 30-40 have launched. What these companies do is take some prompts like “What’s the best medicine for a headache” and run them on all 6 engines to see what the answers are, record those in screenshots and then tell a brand, like an Ibuprofen brand, how they are showing up for X generic consumer prompts and the overall ‘GenAI sentiment’ for their brand. Since all the GenAI answer engines have APIs, this is not technically complicated and many brands are pulling the functionality in-house.

There are two primary reasons these companies are hot right now:

They are a good starting point to give you some visibility into how you are doing in this new battle ground for the hearts and minds (and wallets) of consumers

GEO went from not on any executives radar to a board/large investor top priority seemingly overnight. In the Q2 earnings calls, 55 public companies were asked questions about their GEO strategy.

Implementing a GEO solution is a fast way to ‘do something’ and get some idea what is going on. However most retailers will find it not very actionable. However, by focusing on the specific industry of digital commerce, in this series we will start with details on the specific problems on the Answer Engines and how to spot them and then tie those back to actions you can take on your site and in your product catalog. Everything is actionable in digital commerce in a very short time.

Exponential Growth and GEO….

This brings me to tie together Exponential growth with the GEO topics. While this is only a year old, doesn’t it seem unusual that it’s having such a huge impact and moving to the top of everyone’s priority list? There’s a valid argument that it’s really only 10% of overall traffic to most retailers and brands (similarweb) so what’s the big deal.

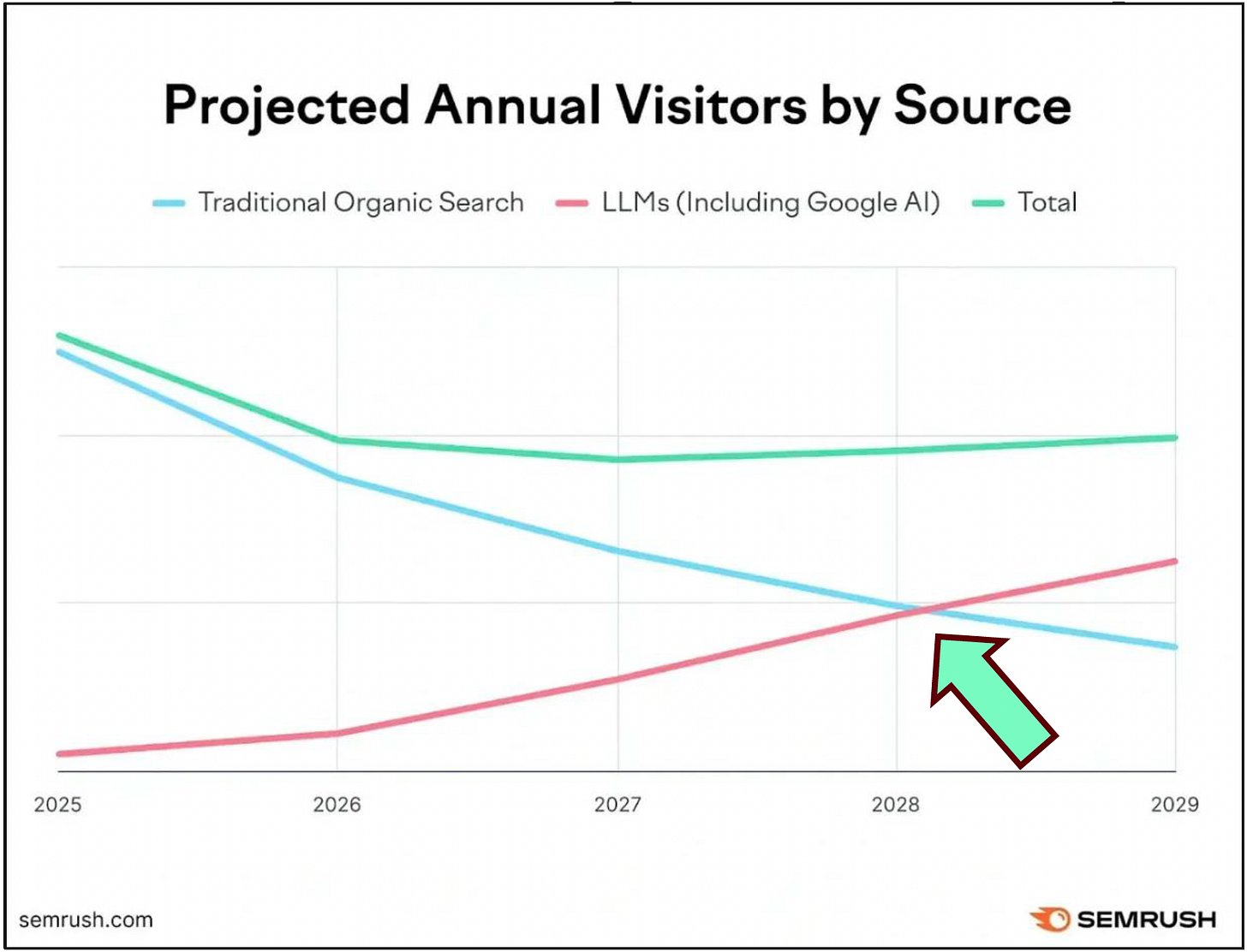

SEMRush published this chart recently that shows the impact when an exponential growth curve hits a zero-sum game (meaning every time the GenAI engine grows it takes share from traditional search). This shows the lines crossing in less than 3yrs - 2028. I actually think it will happen faster (they straight lined the curve fit).

When something is growing exponentially, you need to take action very very quickly or you will blink and it will be over.

How is GEO for Commerce (Retail/Brands/Agencies) Different?

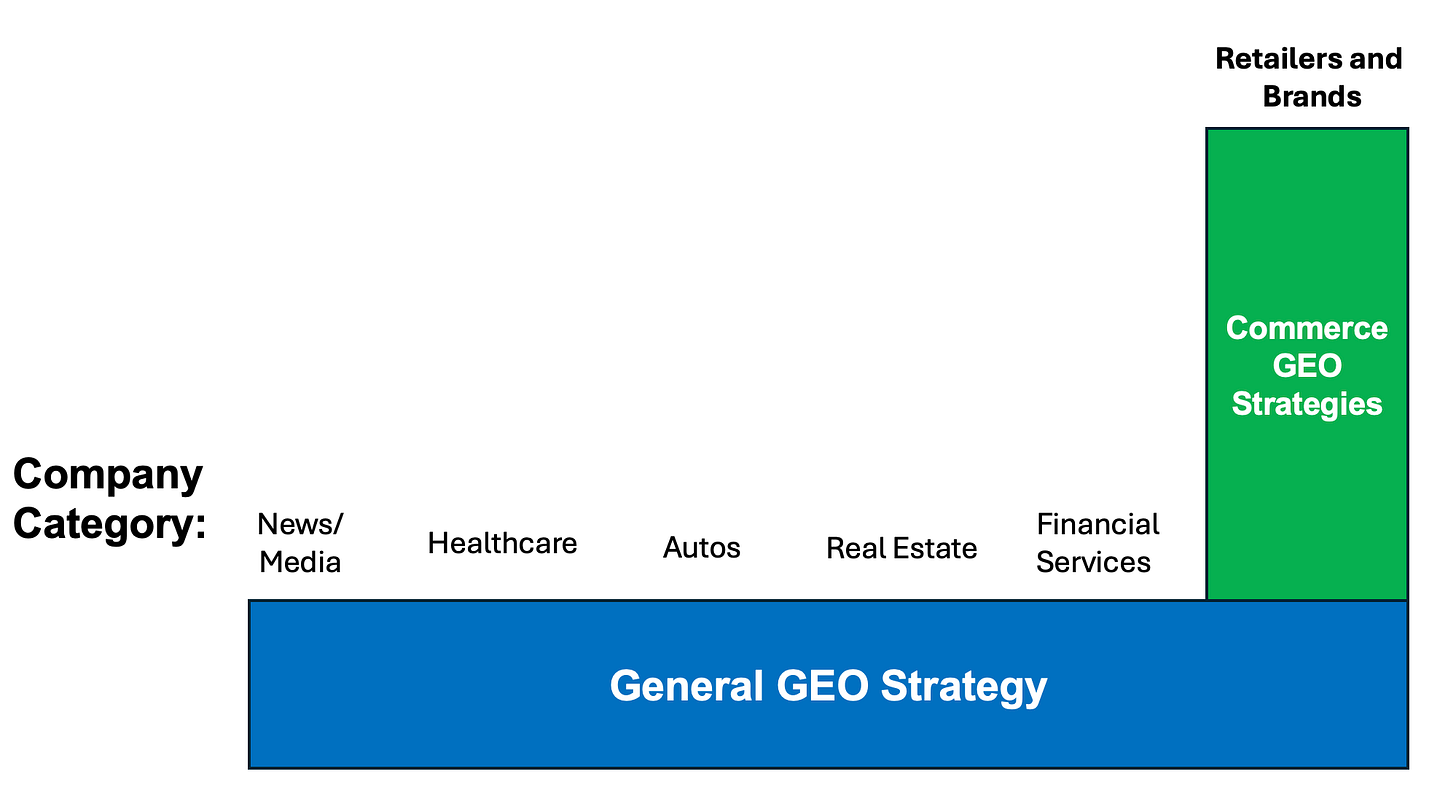

Thus far I’ve been talking about the broader GEO - how it’s impacting every business with a website regardless of if it is commercial or non-commercial. For transactional commerce businesses that sell physical products, there are important differences that dramatically impact your GEO strategies from other types of businesses.

General GEO Strategies like those outlined in the YouTube Video I referenced above work for all companies in all categories, but what we’ll outline in the rest of this series is that for commerce companies (Retailers, brands, travel, agencies that serve those, etc.) while some of the general GEO strategies will help, to really move the needle there are now an even larger set of verticalized GEO strategies you should be evaluating and executing on.

There are two reasons for this difference: Product Cards and the Product Catalog. We’ll explore both next and tie it together with a score card that will be the foundation for the rest of the series.

The Holy Grail 🏆 - “Owning the Product Card”

In November of 2024, Perplexity came out with the first GenAI shopping experience called Buy with Pro - for Pro subscribers. Then in April 2025, ChatGPT came out with the first iteration of their shopping experience, we’ve coined ChatGPT Shopping where instead of text about products found from the Web Search index, they implemented a more graphical interactive shopping experience using what we call Product Cards. This Product Card experience has been replicated by Copilot and at Google I/O they announced theirs is coming soon as well. That gives us Product Cards (more more) functionality at 4/6 of the engines - I’d be surprised if Claude and Grok don’t implement them by Holiday ‘25.

What we’ve learned from 20yrs of marketplaces (Amazon buy-box optimization is not too far away from product card optimization) and comparison shopping engines is a large % consumers take the easy way out and trust the engine’s top pick. This we have coined: “Owning the Product Card”. That’s the goal of Commerce GEO - Own the Product Card for all your SKUs.

That’s super theoretical, let’s look at a real-world example.

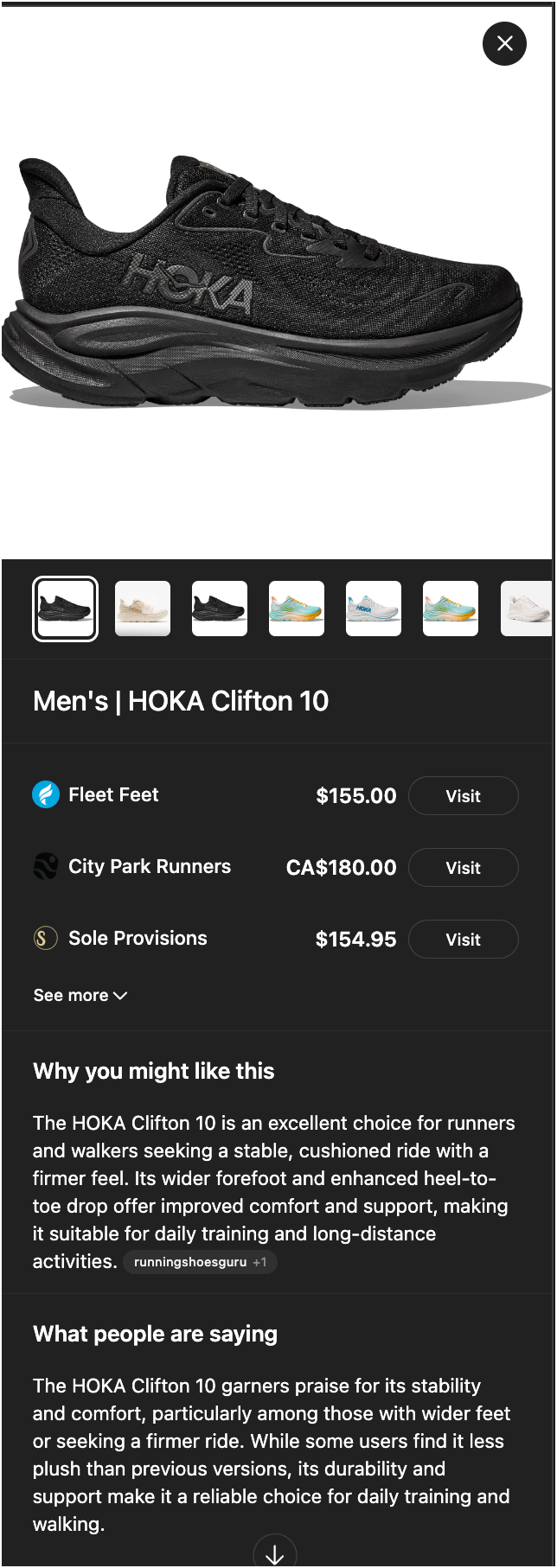

Example: Hoka Clifton 10

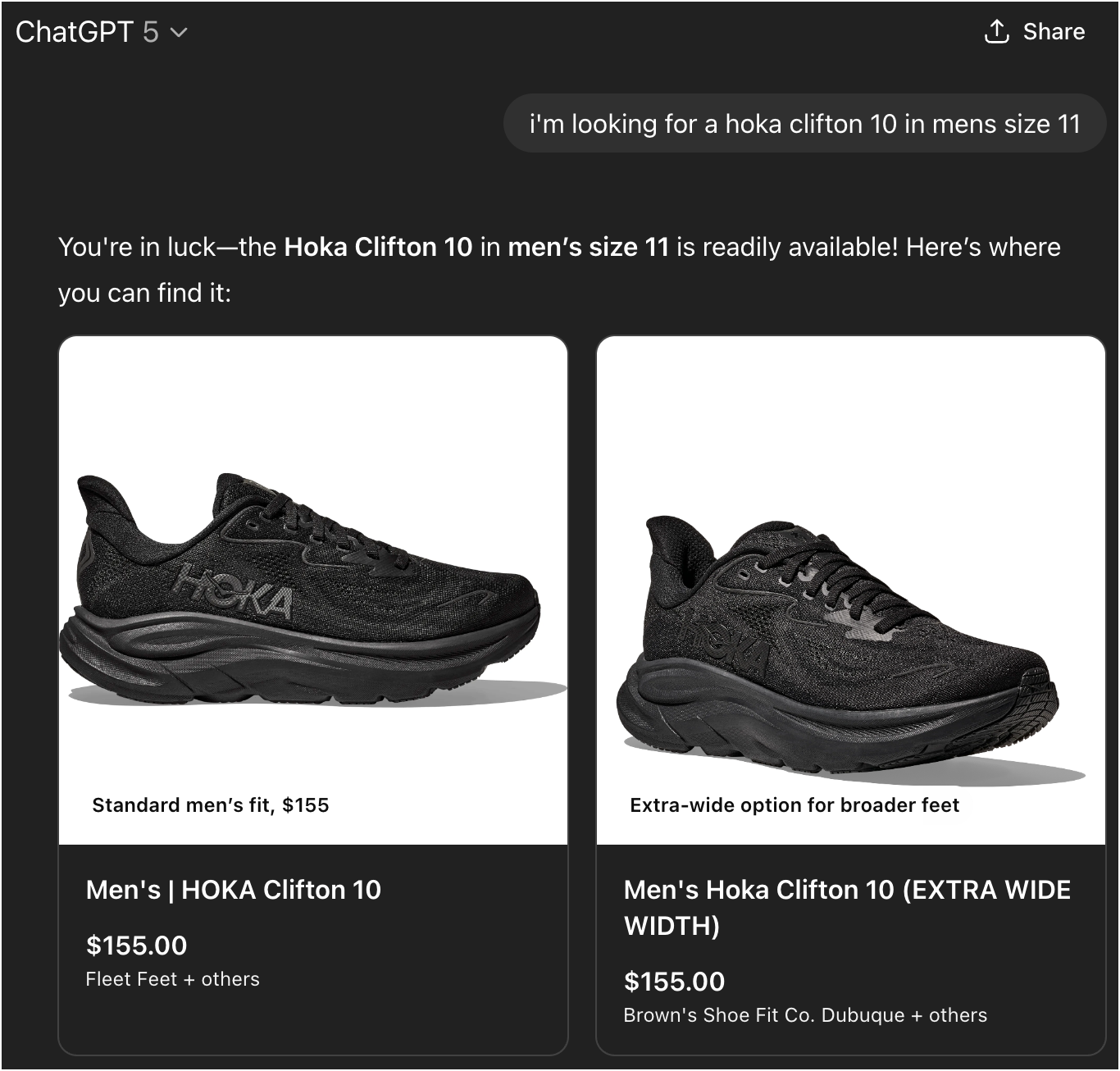

Let’s say you are looking for some new running shoes and you have narrowed it down to a Hoka Clifton 10, you go to ChatGPT and enter a bottom of the funnel prompt:

The user is presented with two product cards - one for standard fit and an extra-wide. If we click on the first one, our initial view is:

In this example, congrats to Fleet Feet, they Own the Product Card and are likely to get this order. Note the second retailer is showing Canadian dollar currency (GenAI is still early and improving daily, this is some of what we have to deal with to optimize).

There’s three ‘offers’ for this show shown by default. That’s what you’re up against.

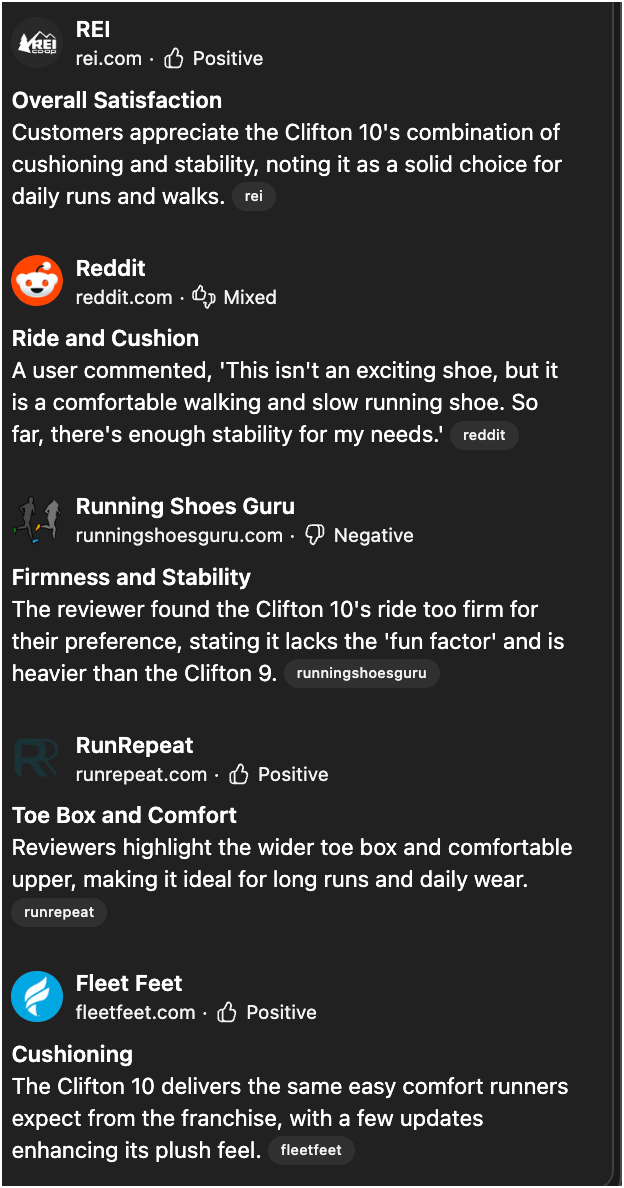

After that you get some pros and cons from the engine and store-specific results from five different sources: (REI, Reddit, Running Shoes Guru, RunRepeat and Fleet Feet)

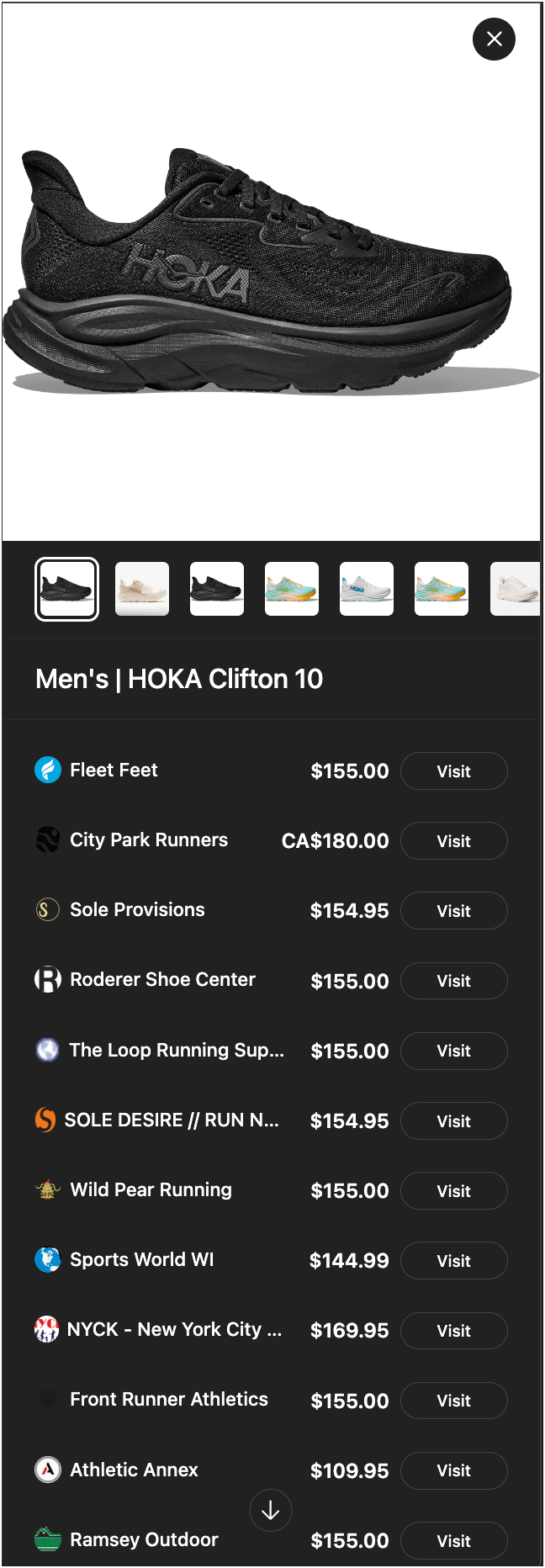

A value-oriented consumer may click the down arrow to see more offers and

Note Sports World has it at $144.99 and Athletic Annex at $110 - clicking into those they are both product catalog (bad canonicalization to be exact) errors:

Sports World - it’s a Clifton 9 not 10 that got rolled into the 10 in error

Athletic Annex - That shoe is a youth with max size 7

As a value-oriented consumer I’m going to quickly realize $155 is the price and I might as well go with Fleet Feet.

Commerce GEO: Product Catalog

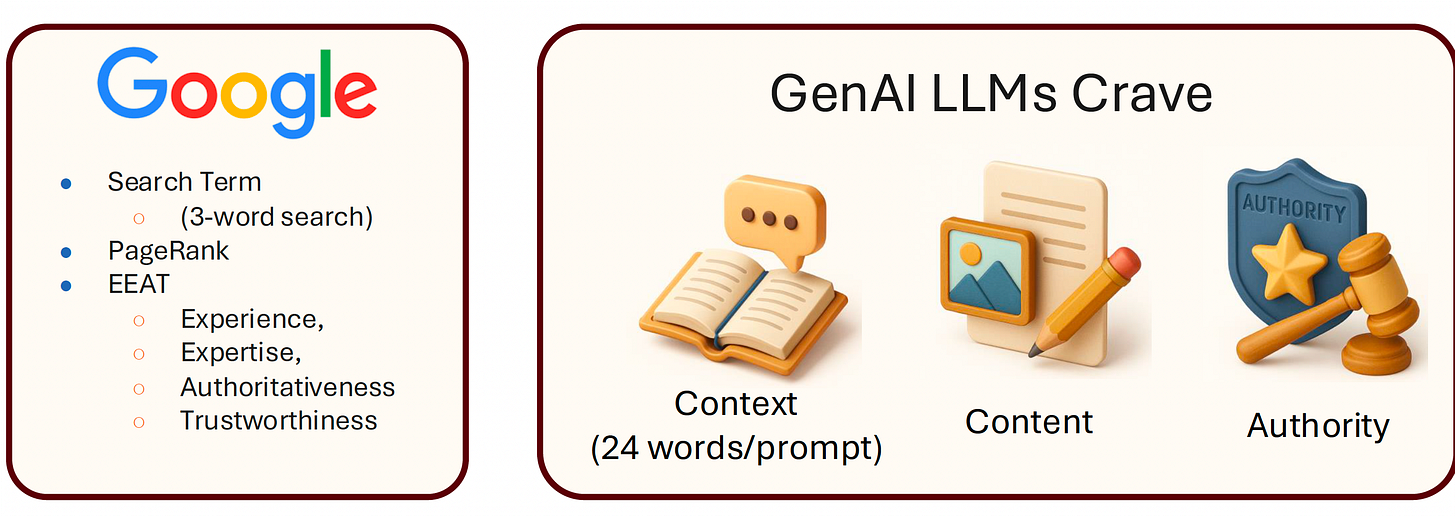

As you learn more about horizontal GEO, you will notice a couple common themes:

Context - GenAI Engines love context - you’ll notice that’s missing from the left list of what traditional SEO/Google optimizes on.

Authority - In the traditional Google/SEO world, Authority comes from PageRank and ‘Authoritativeness’ and ‘Trustworthiness’ Because GenAI can tie topics (like products) together using natural language (see how it found the Clifton 10 information in the example above?)

Content - The heart of all this GEO is content. It has to be quality content, but the more content, with context and high-quality the better.

Retailers, Brands and Content = Product Catalog

In the typical transactional commerce site you have these types of pages:

Homepage - Only one of these!

Category pages - Pages that summarize many products from a similar category, like bestseller pages or new products,

Transactional pages - Search results, cart, checkout

Content pages - Most retailers have a little bit of content

Product Detail Pages (PDPs)- Both in terms of ‘surface area’ (% of pages) and analytics/visits PDPs are by far the top pages of a commerce site.

PDPs are the bulk of a retailer/brands content because, as the name implies they are the product data. Internally at retailers, PDPs are built from the internal database of products for sale called the Product Catalog.

One challenge we’ll talk about in this series is PDPs are designed for humans. You want some great content on there, but there’s an art to not having ‘too much’ content. Most buyers don’t want the equivalent of a 20 page product specification on the PDP. Also most products have a visual (picture of fashion item on a model) or interactive aspect that is very human focused as well. There is some meta data that isn’t visible but readable by crawlers/bots that can help with traditional SEO and now GEO, but in a perfect world a LLM would prefer the 20 page product specification to the human PDP.

Also the way PDPs are designed for humans can give the Web Search crawlers issues with context - in the Hoka Clifton 10 example, the Canadian dollar, youth shoe and the Clifton 9 vs. Clifton 10 can all be solved at the PDP/Product catalog level.

Summary

Adding all this together, the path to Owning the Product Card starts at the Product Catalog.

Introducing the Retailgentic Commerce GEO Scorecard…

To help retailers and brands with their GEO strategy, we’re introducing the Retailgentic GEO Scorecard.

The GEO Scorecard, for short, is a consistent scoring mechanism for SKUs on GenAI engines that allows you to baseline where you are GEO-wise and then as you implement the best practices in this series, you can track your progress towards Owning the Product Card for all your products.

The Retailgentic GEO Scorecard has three components:

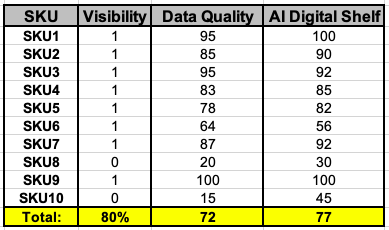

Visibility - The first gate you have in product-level GEO is ‘did the LLM pick up your product - yes or no?’ There can be some shades of grey in this as we’ll see, but for the most part this is 0 - nope you aren’t in there or 1 you are good to go.

Data Quality - It always surprises people new to ecommerce how much data there is needed and how finicky it can get to nail the the buyer experience. As you saw in the Hoka example, a bit of incorrect data can totally wreck the product card experience. Data Quality includes: Title, Price, in/out of stock status, image(s), variations, attributes, language+currency, shipping and tax calculation (if performed), product reviews, correct PDP linked/injected/Agentically purchased, etc. Perfect data yields a 100 score and missing all the product quality components results in a 1.

AI Digital Shelf - The top score of 100 is what you see with Fleet Feet and the Hoka example- Owning the Product card. Even if you are in the game and your data quality is solid, there are factors that could have a competitor beating you out on the Product Card at the same price. Or you may not be showing up at all (1/100). This final component measures that.

Ideally you want to take your number of SKUs and apply this score card across many SKUs. Let’s say you have 100 SKUs, you can run the scorecard for 10% or 10 products. What you want to do is then roll them up like this to get a baseline of how you are performing today.

Once you do this for ChatGPT (I suggest you always start there), then you can baseline where you are for the other engines that matter to you - usually it goes by referral traffic order from most to least which usually results in the sequence of: ChatGPT, Google AI Mode, Perplexity, Copilot, Grok, Claude.

Don’t Panic!

We’ve gone through this exercise with many retailers and brands of various categories and scale and it’s not unusual to find out: Many of your products aren’t showing up at all, your data is wildly wrong for many SKUs and you may not Own the Product Card for many products, yet. That’s ok, the idea of a baseline is this is your low point. In Part II, we’re going to show you the 13 most common pitfalls, and how you can visually identify them on the Agentic Shopping Engines. Then in Part III, we’ll give you the best practices to move your GEO Scoreboard up and to the right!

Super smart and important insights! Thanks Scot!