Fun With Ecommerce Math: Where the Heck Did Sam 'Find' $6,000,000,000?

A fun thought exercise as we head into the key Cyberweek Holiday 25 kickoff!

Did Sam find $6B under the seat cushions at OpenAI’s offices? Let’s speculate and tie it to Agentic Commerce in a fun thought experiment as we head into the ‘go time’ for retail the CyberFive!

Sam Discovers $6B ?!

Since Spring ‘25 and all the way through November, it was first rumored/leaked then Sam all but confirmed that OpenAI’s revenue-run-rate exiting 2025 would be $14B. Given last year they reportedly did $4B. $4→14 is a 3X+ growth which is already amazing and impressive. Usually scale slows things down, not speeds them up. We also know that they did ~$4.5B in the first half of 2025 -already more than 2024.

Then on the BG2 Pod, we had some excitement!

BG2 Pod

On Halloween, October 31, Brad Gerstner dropped an amazing pod with Satya Nadella (CEO of Microsoft and Sam Altman. It was all going well until 11:50. I’ve tee’d the video up to that spot here.

If you don’t have time to watch it, here’s the relevant snippet of the transcript→ (Bolding is mine)

Brad Gerstner:

“With all that said, you know, OpenAI’s revenues are still a reported $13 billion in 2025. And Sam, on your live stream this week, you talked about this massive commitment to compute, right? $1.44 trillion over the next four or five years with—you know—big commitments: $500 million to Nvidia, $300 million to AMD and Oracle, $250 billion to Azure. So I think the single biggest question I’ve heard all week and hanging over the market is how can a company with $13 billion in revenues make $1.44 trillion of spend commitments? You know, and—and you’ve heard the criticism, Sam.”

Sam Altman:

“First of all, we’re doing well more revenue than that. Second of all, Brad, if you want to sell your shares, I’ll find you a buyer. Enough, like, you know, people are—I think there’s a lot of people who would love to buy OpenAI shares. I don’t—I don’t think you—”

Brad Gerstner:

“Including myself. Including myself.”

Sam Altman:

“People who talk with a lot of breathless concern about our compute stuff or whatever would be thrilled to buy shares. So I think we could sell your shares or anybody else’s to some of the people who are making the most noise on Twitter very quickly. We do plan for revenue to grow steeply. Revenue is growing steeply. We are taking a forward bet that it’s going to continue to grow, and that...not only will ChatGPT keep growing, but we will be able to become one of the important AI clouds, that our consumer device business will be significant and important, that AI that can automate science will create huge value. So, you know, there’re not many times that I want to be a public company, but one of the rare times it’s appealing is when those people are writing these ridiculous...OpenAI is about to go out of business and, you know, whatever. I would love to tell them they could just short the stock and—I’d love to see them get burned on that.

There were two things going on with this conversation a big one and an overlooked one:

Sam is a very buttoned up, highly polished executive and while maybe it was humor, this came off as aggressive and snarky and everyone read his body language and Brad’s visible surprise at the reaction as ‘uh-oh we’re in a bubble. Stocks sold off and it’s all we’ve heard about for 12 days now in the VC/CNBC world.

Look at what I highlighted, this is what caught my attention… RECORD SCRATCH. Wait, they did $4B last year and now, like 60 days since he last confirmed the $15B number he’s saying “we’re doing well more revenue than than”.

I couldn’t shake this one. ‘Well more’ what’s that mean?! 10% is a ‘bit more’ 20% is a “good bit more”. What’s ‘well more’? 30% 50%? no, 50% feels like ‘significantly more’. 🤔🤔🤔. Also what could have changed in the last 60 days other than this BG2 interview to get sam to raise his forecast? I’ve run a public company (they aren’t public but with a $500B valuation and his shareholders, you can bet your bottom dollar that and you only raise your forecast if it’s IN THE BAG”.

November 6: Sam Clarifies and Raises OpenAI 2025 Forecast Slightly (43%!!) Via X Post

This whole thing caused such a 💩 storm that 6 days later Sam posted this lengthy note on X.

Here’s the snippet germane to this topic→ (highlighting is mine)

They are going to exit the year at > $20B run-rate (annualized) - that means he’s taking the monthly rate of December’s estimate (MRR) and multiplying it by 12 (to get ARR) and ending up with > $20B.

Realized revenue will be smaller, but still heading into next year with a $20B wind behind your sails is nothing to sneeze at.

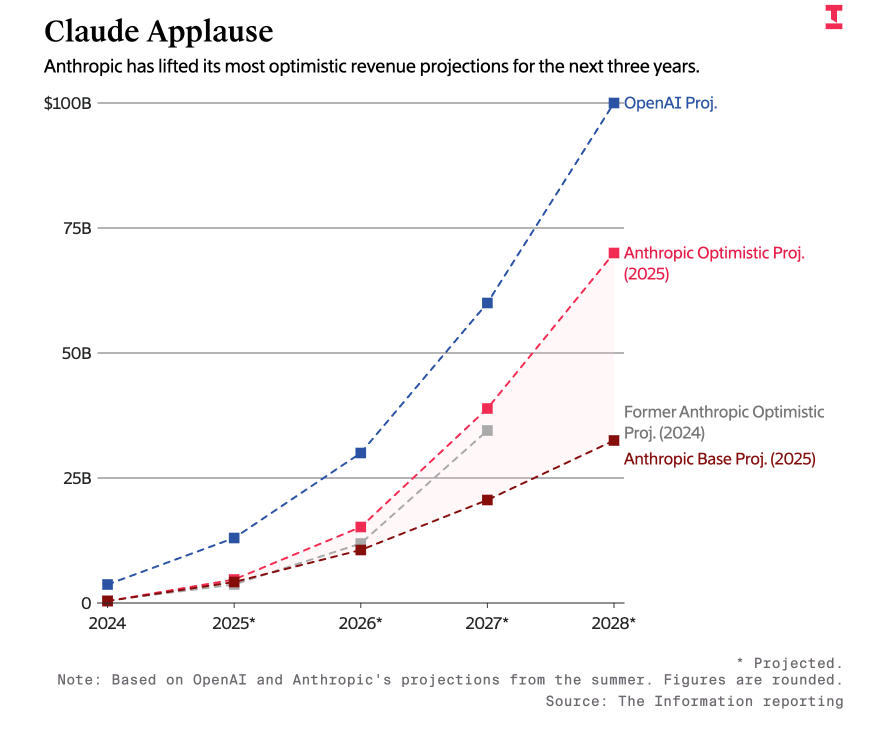

I previously reported that the Information had this handy chart showing the leaked OpenAI and Anthropic Revenue numbers:

Here you can see that OpenAI is showing $27B in 2026, well entering the year at ‘over $20B’ at a 400X curve makes me think that $27 could turn into…$40? $50? IDK, we’re living in a world that’s entirely unprecedented and thus unpredictable.

Fun with Math: Where did Sam Find $6B? Hint: Not the Seat Cushions

At this point you maybe saying - wow, this story has nothing to do with Agentic Commerce, What gives? Well, funny enough, after Sam’s X $20B X post, we were spitballin’ at the RefiBuy/Retailgentic HQ and I threw out there - “Hey where do you think the $6B came from?” We had some ideas - one of which was, well you know…9/30 was the release of Instant Checkout - that and…ChatGPT-5 are the only things they’ve announced in this recent window that could be why they increased the forecast.” 🤔 Now THAT’s interesting to think about. The next week the Adobe October data dropped showing a huge increase in conversion rate and I thought, well you know who would be seeing this? (rhymes with Pam Saltman).

Disclaimer: This is pure speculation and a thought experiment (The $14-$20B is real of course), but given that many of our readers aren’t from the transactional ecommerce world (payments, ads, CPC, AI, etc.) I thought it maybe helpful to illustrate the power of a marketplace, % of sales business model and how we think about the math. If you weren’t a mathlete in HS, don’t panic, we’re going to use basic algebra, and we while I will share the details, they are just FYI.

Also, over the decades I’ve used this approach to back into Amazon’s 3P GMV to within 5-10% before they gave the datapoints necessary in their 10Q’s to get there without approximating. The high/low/midpoint does really well at getting close and, heck it makes a really good cocktail party trick (if you are NRF or shoptalk cocktail parties).

Just how big is the Forecast increase?

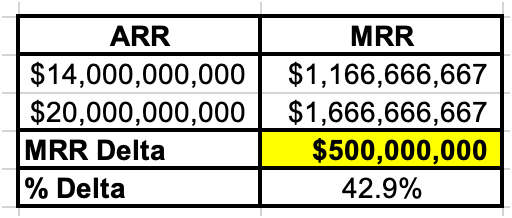

Let’s assume all along we’ve been talking about $14B ARR 2025 exit-velocity and now that is $20B, in subscription revenue it’s easier to deal with MRR so let’s convert to that, look at the monthly revenue increase (delta):

Let’s also pretend that November 1 Sam woke up and realized that something had changed and he could bump up the 2025 exit ARR forecast, that implies a $500m/m increase in revenue. Now it will probably start at $200m and go to $500m by the end of the year, but we don’t know that, we do know that by Dec it has to be $1.7B/m and up until Nov 6, we all thought it was $1.2B/m.

For this thought experiment: ChatGPT found $500m/m (+43% increase) where did it come from?

ChatGPTs Sources of Revenues

ChatGPT has these sources of revenue today:

Consumer Subscriptions - Estimated at 55%, largely agreed this is the lion’s share of ChatGPT’s revenue. These range from $20/m-$250/m.

Enterprise and Teams - (29%) $50/m per user for large orgs

API Access - (15%) All kinds of people calling the OpenAI

There’s data showing that on the API access side, the biggest users are coding tools like Replit, Cursor, etc. and they are all either using Claude/Anthropic or to save costs, moving to Chinese open-model forked and modified models.

Therefore the most likely source of increased income is subscription revenue is from consumers or enterprises/teams.

ChatGPT-5 was released August 7 and there is a valid argument that is has accelerated consumer subscriptions. Prior to ChatGPT-5, a very small % of $20/m and free consumer tiers had experienced the reasoning and deep research models (remember ChatGPT-4o and o3/o4-mini?). ChatGPT-5 got rid of the model picker by default and self-picks the right model including the deeper and reasoning models, probably exposing a huge set of people that never had those experiences to a significantly better (and addicting enough to get you to upgrade) experience.

What Other New Revenue Source Could There Be?

We also know that starting 9/28 with the announcement of Instant Checkout that ChatGPT has a new source of revenue:

ChatGPT Instant Checkout Marketplace Revenue - Nothing is known about this revenue today (but hold on!) and industry gossip is the ‘take rate’ that ChatGPT is charging is ‘low single digits’ with Wall St. firms guesstimating a range of 3-5%.

Estimate: ChatGPTs Incremental Revenue Sources

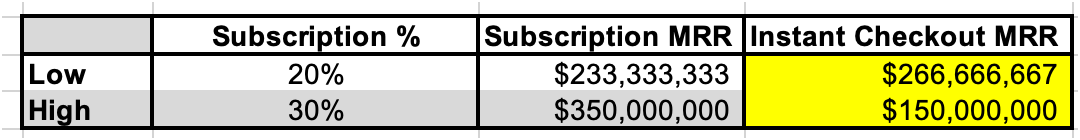

We now know enough to estimate where the new $500m/m is coming from: Subscriptions and Instant Checkout. For this thought experiment, let’s say subscriptions grew enough from the $14B run-rate to take up 50-75% of the 43% increase in revenue:

This gives us a range of $150-$267m/m incremental ‘new Q4 monthly revenue’ generated from Instant Checkout, which together with the $233-$350m gets the $500m/m surge in ARR.

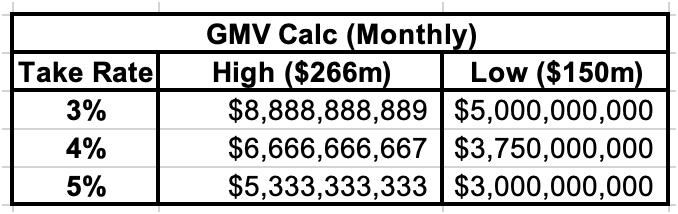

Approximating ChatGPT Instant Checkout GMV

Now that we have a range of $233m-$350m in monthly revenue we can get into some ecommerce algebra fun.

Here’s a little setup before we get into a math explosion:💥

Definition: GMV: Gross Merchandise Value -the value of goods passing through a marketplace that revenue is then derived from via a take rate. Note in the paymernts world they use TPV - Total Payment Volume

What we Know

We know a Revenue Range ($233m-350m)

We know a range of Take Rate (TR) (3-5%)

We know from the Adobe data, that down-stream (Agentic Commerce→website) now converts at 16% better than other traffic sources

From SimilarWeb we know that ChatGPT has DAUs (Daily Active users) of 250m/day

We know from survey data that amongst those 250m/day consumers, 70-80% are shopping via ChatGPT.

We know the average ecommerce Average Order Value (AOV) is $88-102, but the Average Sales Price (ASP) is ~ $80 - Instant Checkout is currently single item/checkout so we’ll go with $80.

Formulas

Marketplace Revenue - To calculate the revenue for a marketplace you take GMV over a period of time (all calcs in this argument are monthly GMV/M * Take Rate or states as a ‘formula’: marketplace_revs=GMV*TR.

GMV - If we know Revenue and we know the Take Rate you can calculate GMV by solving for GMV and you get this formula GMV=(marketplace_revs / TR).

Orders - If we GMV and ASP ($80) we can calculate order volume: order_volume=(GMV/ASP).

Calculating GMV and then a Sanity Check

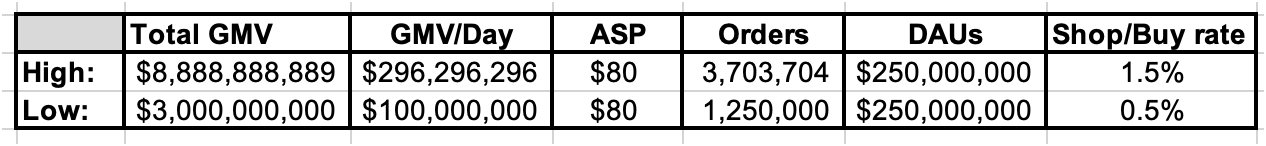

We know have everything we need to calculate a range for GMV. Here we take the low/mid and high end of our Take Rate and we then take our High and Low of our revenue ($150m-$266m) and we use the GMV formula above to calculate GMV/month→

This gives us a big range of $3-$8.9b with around $6b in the mid-point.

Those are big numbers - $3B/m feels a bit high, $8.9b seems astronomical to me.

But let’s do a bit more math for a sanity check.

Here we

o Get to GMV/day by dividing GMV/30 days in a month

o We get to daily orders by dividing daily GMV by the ASP

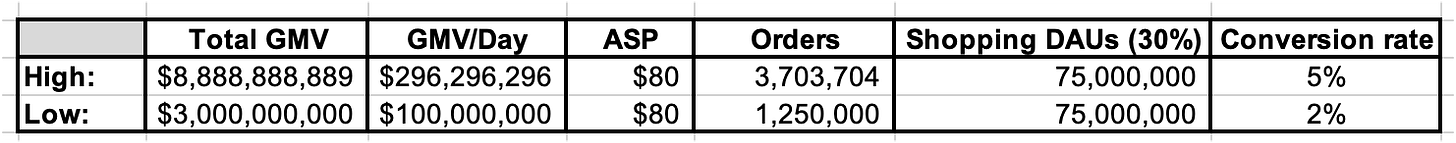

o We then do a sanity check - how many people have to both shop and buy a day as % of those DAUs -for example, if this ‘top down’ model (GMV→user activity) spits out 50% that would be crazy high. This comes out to a range of .5%-1.5% which honestly doesn’t seem crazy to me, however, it would be cleaner to split that out to two stages, shopping and then converting. Let’s do that→

Here everything is the same, and then right of the orders column we take the DAUs and and give it a 70% haircut and say - 30% of DAUs will go shopping, and then we take (orders/shopping DAUs) and get a conversion rate which ranges from 2-5%. This also doesn’t seem crazy to me given what we know from the Adobe data.

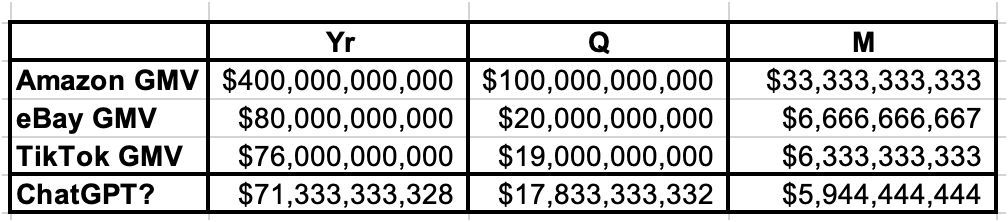

One last sanity check, let’s compare the mid-point of ChatGPT’s high/low and compare it to 3 other more mature marketplaces:

eBay - the OG pure marketplace

Amazon - Hybride 60% marketplace 40% retailer

TikTok - Social media new kid on the block (TikTok Shop)

Here’s where I have major doubts.

Conclusion

We learned three things in this thought experiment:

We showed how we think about this in the marketplace world and introduced you to the ‘math of marketplaces’.

Based on my Amazon experience, we’re going to be doing a lot of these types of calculations here at Retailgentic and this post will serve as a foundational ‘marketplace/ChatGPT Instant Checkout math ‘anchor’ post we can reference back to over the coming months and years.

Illustrate how hard it is to predict things in this world.

My analytical brain says:

Assumptions we’ve made here all are a ✅

DAUs times a low conversion rate times a basic ASP - ✅

ChatGPT building an eBay scale marketplace in 60 days 🤯

But, we’ve also never seen a company get to 1B MAUs this fast, all the data is it is closing in on big apps like TikTok. TikTok’s user→buyer conversion should be much smaller because the % of people using it to shop is tiny vs. ChatGPT at 80% now.

In the end, this is what makes this space so exhilarating. It seems impossible they could do this based on past facts prior to 2022, but facts after 2022 make you say, well, you know…maybe it is possible. Maybe they will pull it off….

At the end of the day your guess is as good as mine - I’d love to hear your thoughts in comments or chat→

Hi Scot, long time reader here — thanks for sharing this thought experiment! The velocity is wild to see, they really blew past everyone in onboarding users, reaching 100 million users in 2 months, TikTok took 9 months to hit the same milestone, and eBay took years.

Just wanted to raise one modest caveat about the math: it assumes checkout functionality is universally available now, but I believe that’s unlikely— at the moment, it’s probably mostly available in the US/Canada + Europe (which accounts for <50% of global visits to ChatGPT according to First Page Sage, with India+Latam accounting for >30%), given payment infrastructure (e.g., Shopify + Stripe) are not yet broadly supported outside the US/Canada+Europe — then the implied GMV/volume numbers seem harder to reconcile.

Having said that, I remain a crazy strong believer in agentic commerce (and I’m building my startup marketplace on that bet). Thanks again for all your work, you are the GOAT!